- Lordstown Motors went public on Nasdaq in October 2020, promising to revolutionize the EV sector with its commercial fleet-focused Lordstown Endurance. The company raised more than $675M from investors at the time of merging with SPAC DiamondPeak Holdings to go public.

- The company aggressively promoted Endurance as an economically viable option compared to other EV trucks promised by leading automakers and even went on to claim that it would take market share from the Ford F-150, the best-selling truck in the United States.

- After revealing pre-orders for approximately 100,000 Endurance vehicles in early 2021, Lordstown stock skyrocketed to an all-time high of over $460 in February 2021 (pre-reverse split). After being rebranded as Nu Ride, the stock now trades at $1.70.

- Hindenburg Research, in a report dated March 12, 2021, revealed that Lordstown has been deceiving investors by omitting key information regarding pre-orders for Endurance.

- Lordstown filed for bankruptcy in June 2023, blaming Foxconn, a business partner and investor, for failing to deliver commercial and financial commitments that led to “material and irreparable harm” to the company.

- The SEC charged Lordstown in February 2024 for misleading investors with fictitious Endurance pre-orders and concealing Lordstown’s inability to access critical components for the production of EVs. Lordstown agreed to a payment of $25.5M to settle the claim.

- Lordstown Motors will pay up to $10M settlement due to this situation. All affected investors can file a claim to receive the payment.

Overview

Lordstown Motors burst onto the scene in 2020 promising a revolutionary electric truck and raking in over $675 million from investors. The company aggressively marketed the Endurance, its first EV truck, as a competitor to established automakers, sending the stock soaring. However, this house of cards came crashing down when Hindenburg Research exposed Lordstown for misleading investors about pre-orders and production capabilities in early 2021. Since then, the stock has crashed, the company filed for bankruptcy before emerging from Chapter 11 as Nu Ride, and the SEC charged Lordstown for misleading investors. Lordstown has now agreed to settle with the SEC and defrauded investors, bringing closure to a cautionary tale of hype and deception.

Introduction

Lordstown Motors, now rebranded as Nu Ride Inc. (NRDE), was founded in 2018 by former CEO of Workhorse Group, Steve Burns. The company, from its IPO in October 2020 through its Chapter 11 filing in June 2023, aggressively marketed its vision of revolutionizing the American commercial and passenger vehicle industries with Lordstown Endurance, its flagship electric truck that promised to compete with established automakers such as Tesla Inc. (TSLA) and Ford Motor Company (F) for market share. Lordstown Motors, which was valued at almost $5 billion in February 2021 before Hindenburg’s report, now has a market capitalization of just $27 million after wiping billions of dollars of investor money off the table.

The Scandal

Lordstown Motors’ deceptive actions span across three distinct categories.

First, Lordstown inflated pre-orders for Endurance, misleading investors about the revenue growth potential of the company. On January 11, 2021, Lordstown announced surpassing 100,000 pre-orders for Endurance. Commenting on this, CEO Steve Burns said:

“Receiving 100,000 pre-orders from commercial fleets for a truck like the Endurance is unprecedented in automotive history. Adding in the interest we have from federal, state, municipal and military fleets on top of that, I think you can see why we feel that we are about to revolutionize the pickup truck industry.”

At the proposed maximum retail price of $52,500, pre-orders for Endurance promised to bring in approximately $5 billion in revenue. Investors, based on this promising pipeline of orders, rushed to own a piece of the company, pushing Lordstown’s market value close to $5 billion in February 2021.

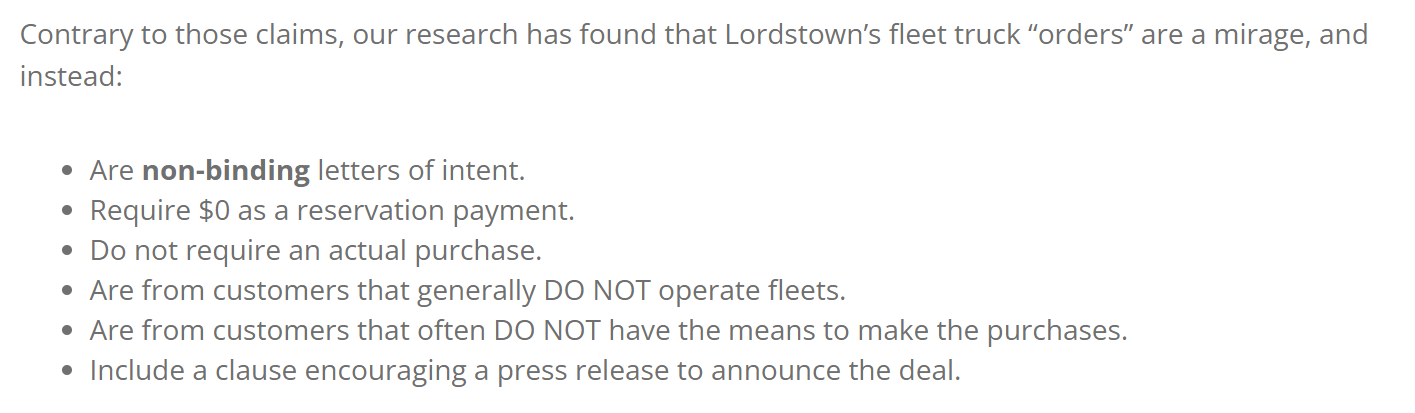

On March 12, Hindenburg Research revealed that most of these pre-orders were fictitious or were placed by companies that had no financial backing to follow through with purchasing the Endurance truck.

Lordstown Motors never accepted or requested deposits from most of the customers who were interested in purchasing its EV truck, contrary to the standard practice. For example, Tesla, the EV market leader in the U.S., required a deposit of $100-$150 for placing a pre-order for the Cybertruck in 2019.

Lordstown Motors’ decision to claim pre-orders as confirmed sales without even securing a deposit seemed questionable even at that time, and the fears were confirmed when none of these orders were delivered in the years that passed.

The company also used inflated pre-order figures to raise funds from investors, misguiding the market about the true nature of the demand for its Endurance truck.

Second, Lordstown Motors misled investors with details of its production timeline, stating that the company was on track to bring the Endurance to the market well before any other EV pickup truck. Originally, the company claimed that commercial production would begin in September 2021 following Beta prototype testing and two pre-production runs.

In January 2021, Lordstown pledged to bring Endurance to the market before many established players and also promised a more affordable price tag, giving the false impression that Endurance would aggressively take market share from ICE pickup trucks that have been dominating both the passenger and commercial truck market in the United States.

Revealing production targets, Lordstown projected the production of approximately 2,000 trucks in 2021 alone. The below table, based on the company's filings, highlights the rosy production targets published by the company.

Commenting on the progress of production during the Q1 2021 earnings call, CEO Steve Burns said:

“Our mission here at Lordstown Motors is to be the leading manufacturer for electric light duty trucks in the United States. Our first vehicle, the all-electric Endurance work truck is on track to start limited production in late September, and we expect to start deliveries later in the fourth quarter.”

Despite these ambitious predictions and misleading statements, Lordstown Motors ended up delivering just 6 Endurance EVs before production was halted earlier this year.

Third, Lordstown Motors failed to disclose critical information about its financial health and production challenges, leading investors to believe that the company was fulfilling its obligations to shareholders. A classic example is how Lordstown claimed it had access to critical vehicle parts from General Motors to design and produce the Endurance, when in reality the company did not have any such access. From the time of its IPO through January 2021, Lordstown claimed on several instances that it would get access to more than 200 General Motors’ vehicle parts, including 100 non-customer-facing parts necessary to bring the Endurance truck to the market within the projected timeline.

The following is an excerpt from the Prospectus filed by Lordstown before its IPO in 2020.

“The Endurance body is designed to be fully compatible with existing third-party parts, upfitting options and accessories. Depending on how our timing and demand aligns with the availability and cost of these parts, this design provides us with the option to source certain parts under an agreement we have entered into with GM. This agreement provides us with access to certain non-customer-facing GM parts, including airbags, steering columns and steering wheels, based on the manufacturing capacity of GM’s suppliers. To the extent we utilize this arrangement, we expect that it will reduce the time that it will take to build out these aspects of our supply chain and bring the Endurance to market and reduce our tooling and development costs.”

These statements played a crucial part in luring investors to invest in Lordstown in the hopes of the company gaining a first-mover advantage in the EV commercial truck market.

After Hindenburg Research highlighted Lordstown’s misleading statements on March 12, 2021, Lordstown Motors issued a statement regarding this short-seller report on March 15, 2021. In this statement, Lordstown defended its progress toward delivering Endurance trucks later that year and wrote:

“Lordstown Motors remains on track for start of production of its Lordstown Endurance all electric pickup truck in September 2021. This week, the company intends to elaborate on its progress towards start of production, including providing an update on beta vehicle production and other important business developments, on its inaugural earnings call.”

Despite this reassuring statement, Lordstown CEO appeared on CNBC Squawk Box on March 18 – just three days later – and claimed that the 100,000 pre-orders should never have been viewed as confirmed orders. Steve Burns, during this interview, said:

“We’ve always been very clear, right? These are just what they’re intended to be. These are non-binding, letters of intent. They’re called preorders out in the real world. I don’t think anyone thought that we had actual orders, right? That’s just not the nature of this business.”

The CEO made these comments soon after the SEC sent a letter to Lordstown inquiring about its business operations.

The company, however, appointed a special committee to investigate the claims made by Hindenburg Research.

On June 14, 2021, Lordstown published the findings of the special committee and denied some of the claims of Hindenburg Research but acknowledged that the company may have issued false, misleading statements regarding pre-orders. Revealing the findings of the committee, Lordstown Motors wrote:

“One entity that provided a large number of pre-orders does not appear to have the resources to complete large purchases of trucks. Other entities provided commitments that appear too vague or infirm to be appropriately included in the total number of pre-orders disclosed.”

Following the findings of this committee, CEO Steve Burns and CFO Julio Rodriguez resigned from their positions.

The SEC concluded its investigation earlier this year and found that Lordstown Motors has violated several guidelines of the Securities Act, including 17(a)(2) and 17(a)(3). Commenting on these violations, Mark Cave, Associate Director of the Division of Enforcement at SEC, said:

“In a highly competitive race to deliver the first mass-produced electric pickup truck to the U.S. market, Lordstown oversold true demand for the Endurance. “Exaggerations that misrepresent a public company’s competitive advantages distort the capital markets and foil investors’ ability to make informed decisions about where to put their money.”

Lordstown reached agreements to resolve allegations of misconduct by the SEC and two shareholder lawsuits. The company will pay $25.5 million without admitting or denying wrongdoing. The SEC will then withdraw its claim in Lordstown's bankruptcy case. The below excerpt from the SEC’s order summarizes its undertakings.

Ex-CEO Steve Burns, in an email statement to Reuters, denied any wrongdoings last March following the SEC’s order and claimed that his actions were “falsely characterized” by the SEC. He went on to say:

“I categorically reject the suggestion that my actions constituted wrongdoing.”

Resolving the scandal

Lordstown Motors agreed to a settlement with the affected investors on March 6, 2024, and a court hearing is scheduled for June 11. The total cash settlement amount can reach up to $10 million.

If you invested in Lordstown Motors between August 3rd, 2020 and July 2nd, 2021, or held Lordstown Class A common stock on September 21st, 2020, you can file for the part of this settlement to recoup some of your losses. The deadline for the claims is in July this year, so if you were damaged, you can check the details and file for the payout here.

Wrapping up, the company, now rebranded as Nu Ride, operates as a shell company to carry the Chapter 11 Cases and Plan. The production of Endurance has been halted since June 2023 and the company does not conduct any business as of today.

%%type:order-card,id:1156%%