Recent months have witnessed a major crash in crypto assets that affected the overall reputation of the market. Class action cases have already been initiated against several Development Companies, Leaders, and Founders, in some of which the latter went into deals. Many major cryptocurrencies have been affected by that crash, such as bitcoin and Tether. In this article, we'll explain what happened to the market because of the Terra-Luna case and whether it is safe to go back in or not.

In the crypto world...

Covid pandemic, economic crisis, high inflation threats, shutting down economies, and many lost jobs. These were the economic realities in mid-2020, which in turn made people think of forms of investments that, somehow, were out of the box and profitable in contrast to the traditional investment tools which were doing very poorly at that time, and some of them are continuing in a descending curve. Crypto was the magical solution then as the news was replete with headlines about the new economy of cryptocurrencies, and about the variety of its selection of currencies stating the fact that it's not just the bitcoin that was making crazy earnings, but also other currencies were doing very well. Currencies such as Ethereum, Binance Coin, US Dollar Coin, and many others were getting well-fed at that time. Even the great Elon Musk picked up Dogecoin and started pushing it through his tweets. By 2021, more than 300 million people were investing in cryptocurrencies according to Triple-A company's statistics.

What are Stablecoins?

The crypto market is very volatile and continuously has rough ups and downs that could earn you millions one minute, and make you go broke the next one. So, it's highly dependent on the timing of your trade. You can buy a bitcoin at 30,000$ per coin today and then sell it after 2 months for 55,000$ per coin. It's an absolute win. But let's say that you heard that the currency would rise to 60,000$ after 3 months, so you waited, and then you got shocked by the 20,000$ price tag. You lost a considerable amount of your money. That's because the crypto market can never be predicted, it's pure luck. So, as a strategy to make it a more stable market and somehow appealing to risk-averse investors, they came up with the new concept of stablecoins. The thing about it is that it possesses a fixed value and is linked to a fiat currency like USD or Euro, and the responsible entity that launches the stablecoin backs it up with assets to cover its value. Stablecoins could be considered as a bridge between the typical crypto like Bitcoin and traditional currencies like the US Dollar.

Stablecoins can be classified into 2 categories: Collateralized stablecoins and Algorithmic stablecoins. The collateralized type has a fixed price which is usually equal to 1 USD, and it must have coverage that is equal to or greater than its total value. An example of this type is Tether. So, let's say that there is 50,000 tether coin in the market, so it's mandatory to have assets equal to 50,000$ as collateral since 1 tether = 1 USD.

How the TerraUSD became a player in the crypto market?

As for the algorithmic type of stablecoins, it's not covered by any type of assets or bank accounts. The developers who invented this type explained that the guarantee for the currency value of 1 USD is attributed to its algorithm. This doesn't rely upon any economic principle. The most famous currency of this type now is TerraUSD which is the reason behind the major turbulence the crypto market's having today in conjunction with its twin Luna.

What rationale is behind the arbitrage algorithm?

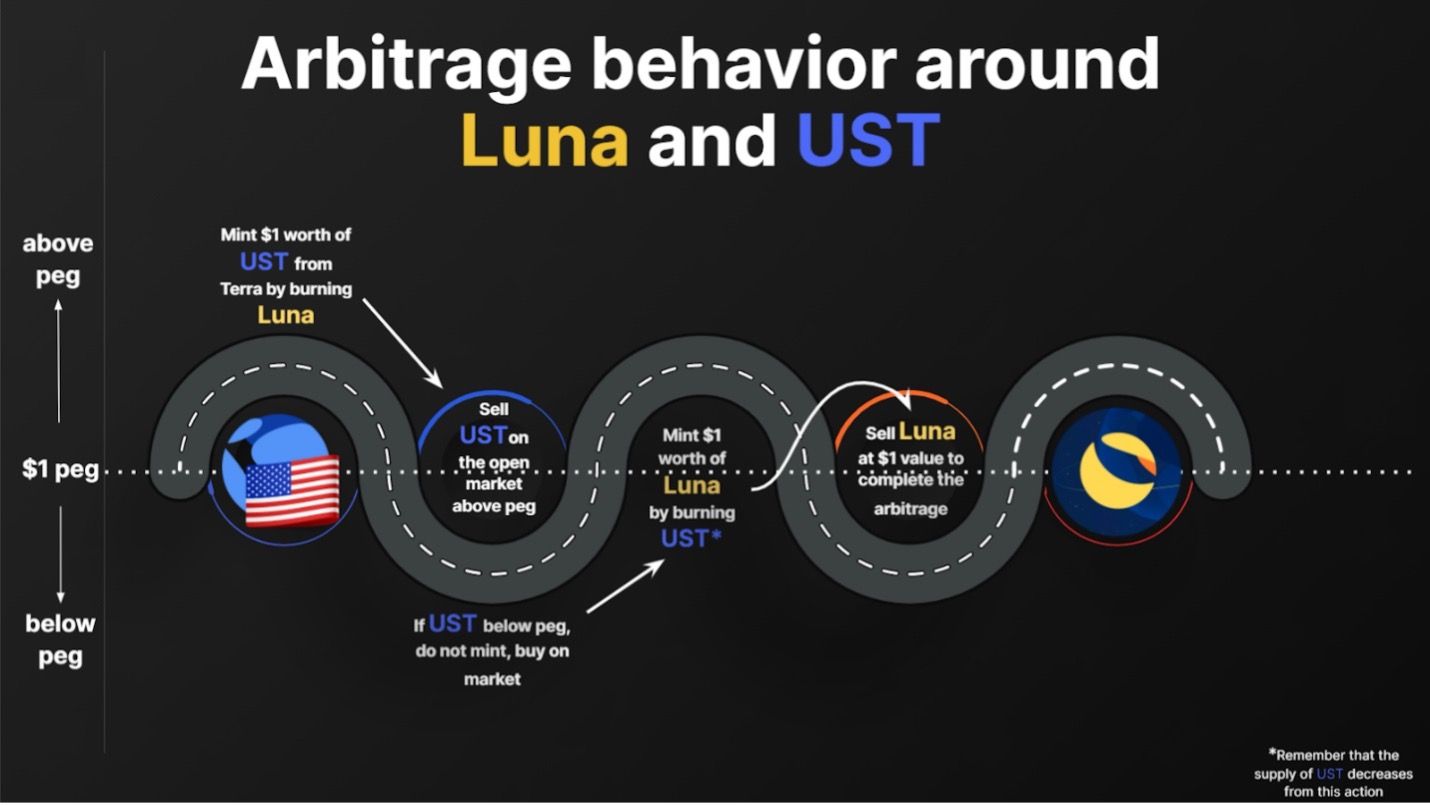

In February 2019, a South Korean programmer called Do Kwon launched a cryptocurrency called Luna through his company "Terraform Labs". In September 2020, Kwon launched a stablecoin named TerraUSD, given that 1 TerraUSD = 1 USD. When asked about the algorithm that binds the TerraUSD at 1 USD, Kwon said that there is an algorithm called arbitrage, which is simply a connector between Terra and Luna. This algorithm enables an unlimited transfer between the TerraUSD and Luna. Luna is classic crypto that possesses a volatile value according to supply and demand in the market, while Terra has a fixed value of 1 USD.

But how does that guarantee the stability of TerraUSD at 1 USD?

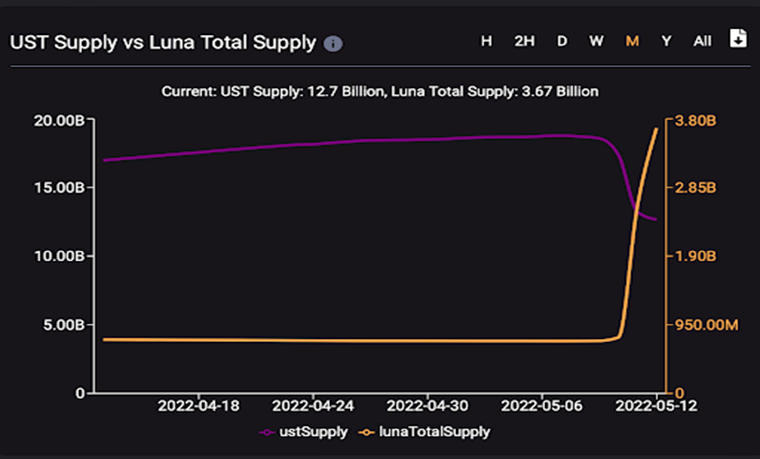

The Answer lies in burning the used coins. This means that any UST used in a transaction inside the algorithm of UST-Luna gets burnt immediately. In the previous example, the 1000 UST you used to buy 500 Luna with, are burnt once you bought the Lunas. Thus, reducing the amount of UST in the exchange market and on a large scale of this maneuver, the value of UST rises back to 1 USD. With every new Luna, there is a UST vanishing from the market. If the amount of Luna exceeds a certain limit, its value will drop like any supply and demand system. But this is not okay with the TerraUSD holders because as we noted above, Terra is covered and supported by Luna. This will lead to another wave of buying Luna and burning UST and this gets Luna cheaper … it's a loop called the death spiral. And that is what happened with Luna and Terra in the past weeks.

How does this mechanism deteriorate TerraUSD and Luna?

Terraform labs set up a platform called Anchor Protocol to increase the demand for TerraUSD. The rationale behind this platform is for TerraUSD investors to deposit their holdings at the platform at 19.5% interest. On the 6th of May 2022, there were deposits equal to 14 billion dollars. Suddenly, this number dropped to 8.7 billion dollars only after 3 days, on the 9th of May 2022. This happened simultaneously with the American Federal Reserve’s decision of raising the interest rate which offered a 100% guaranteed investment opportunity. Investors began to withdraw from UST and buy Luna to break free with a profit margin and this made Luna lose its weight in the market. Its price dropped from 116$ in April 2022 to 0.0002$ now, after it reached 7 trillion Lunas in the market. On the other hand, investors couldn't escape through UST directly because its value dropped from the fixed value of 1 USD to 17 cents. Anyone who invested in UST because it's a stablecoin suddenly went broke.

All of this happened because there is no cover or asset to back the 2 currencies. This dramatic scenario affected other currencies like Tether which dropped to 95 cents before it rebounded to 1 USD again. The famous Bitcoin was also got affected. It lost around 26% of its value in the last weeks and hit 30,000$ on the 17th of May 2022. Of course, the Terra-Luna drama is not the only reason behind the drop of Bitcoin, it’s a multi-factorial case.

What's next for the Terra-Luna case?

As a positive response to the crisis, Kwon said through a thread on Twitter that his team will increase the base pool from 50M to 100M SDR and decrease Pool Recovery Block from 36 to 18. He expects this to increase minting capacity from $293 million to around $1200 million ($1.2 billion). This will enable the team to mint four times more UST than usual. But as a matter of fact, the rebound and resurrection of TerraUSD and Luna are not predicted at all now, and it's not considered a viable investment opportunity, according to multiple economic reports.

On May 14th, 2022, Kwon proposed the first revival plan which was simply abandoning the TerraUSD and redistributing Luna tokens among the community members, but it didn't make the smallest difference.

On May 28th, 2022, Terraform labs came up with their second revival plan which is called the Terra LUNA: Hard Fork. That means validating the entire invalid blocks and transactions on the network. The new plan will make sure that Terra is not attached to the ongoing Terra blockchain, and it will be linked to a new one, then the terra token will turn into Terra Classic, a Terraform Labs' not algorithmically designed stablecoin.

As for the Luna holders, Kwon delivered a message to them on the Terra Research Forum. “The holders of Luna have so severely been liquidated and diluted that we will lack the ecosystem to build back up from the ashes. While a decentralized economy does need decentralized money, Terra has lost too much trust with its users to play the role.” To preserve the community and the developer ecosystem, Kwon suggested to redistribute the network's Luna tokens to 1 billion making the old Luna called Luna Classic. 40 million tokens would go to the investors who held Terra at the time of the hard fork upgrade. Another 40 million will be distributed to holders before Terra became de-pegged from the US dollar 2 weeks ago. 10 million to Luna holders and the remaining 10 million will be used to pay for developing the network later.

The plan also included issuing Luna 2.0 the last weekend. Luna 2.0 tokens started at $17.8 and on May 28th it reached $19.53 before it dived to $5.45 over the next 48 hours.

Who is to blame, the market or management?

Although the company tries hard now to save the tokens from collapse and burn, the legitimate question is whether they did anything to prevent and fix dramatic consequences for holders. According to the management of Luna Foundation Guard, on May 10 they used their reserves to support the coin but in fact, we can only say that the collateral from the LFG disappeared from its official wallet, the facts of the use of funds for protection were not provided. Moreover, Binance Founder and CEO, Changpeng Zhao in the UST delisting announcement has publicly slammed Terraform Labs over its handling of Terra’s collapse: “I am very disappointed with how this UST/LUNA incident was handled (or not handled) by the Terra team. We requested their team to restore the network, burn the extra minted LUNA, and recover the UST peg. So far, we have not gotten any positive response or much response at all”.

On September 14, 2022, Bloomberg reported that a court in South Korea issued an arrest warrant for Do Kwon, the founder of the Terraform Labs cryptocurrency ecosystem, whose implosion earlier this year sparked a global crypto rout. Allegations include violations of the nation’s capital markets law.

Was it the fault of the founders and management in the emergence of such a dramatic situation in the case with Terra? - in the traditional stock or bond markets such issues are investigated and resolved by regulators who protect investors from the risk of mismanagement. And in the case of fraud or negligence, investors have the necessary avenues to claim damages. But the cryptocurrency market is still not sufficiently regulated, and it is very difficult to protect holders from management dishonesty, and the possibility of holding the latter accountable is limited. However, the 11thestate plaform gives a chance for the affected Terra holders to Join Case versus founders and management and try to get compensation for their losses.

%%type:order-card,id:77%%

%%type:order-card,id:257%%

%%type:order-card,id:258%%

%%type:order-card,id:261%%