- In May 2019, Uber raised $8.1 billion in its IPO by selling 180 million shares at $45 each.

- The company pursued a growth-at-any-cost strategy, focusing on expansion rather than profitability.

- This business model came under scrutiny when Uber reported a $5 billion loss for Q2 2019 and a slowdown in revenue growth.

- Soon after the IPO, Uber was accused of bypassing regulations and overlooking passenger and driver safety in some markets.

- By October 2019, just five months after its debut, the company had lost a third of its market value amid these challenges.

- In response, shareholders filed a lawsuit in October 2019, alleging that Uber’s IPO breached securities laws.

- Uber has agreed to a $200 million settlement with shareholders to resolve the lawsuit. Affected investors can now file a claim to receive their payment.

Overview

“We are just getting started. We believe that Uber is on track to becoming a multi-decade, multi-giant company and a world-changing organization. We are moving fast to grow our platform, scale our operations, and improve the lives of our users around the world.” – CEO Dara Khosrowshahi's comments from the IPO filing.

Uber Technologies, Inc. (UBER) went public in May 2019, at an IPO price of $45 per share, raising just over $8 billion in what was one of the most anticipated market debuts in the recent past. On the back of a strong growth track record, the company promised to aggressively expand globally soon after its IPO. These promises were scrutinized by investors when the company reported Q2 2019 earnings, showcasing a deceleration in gross bookings and revenue growth. With its poor track record of dubious business practices also making headlines, Uber stock lost momentum soon after its IPO and crashed to around $30 by October 2019. The steep decline drew criticism from analysts and investors, leading to a lawsuit filed on October 4, 2019. A couple of months ago, Uber settled the lawsuit by agreeing to pay $200 million to affected investors.

Uber’s Costly Downturn

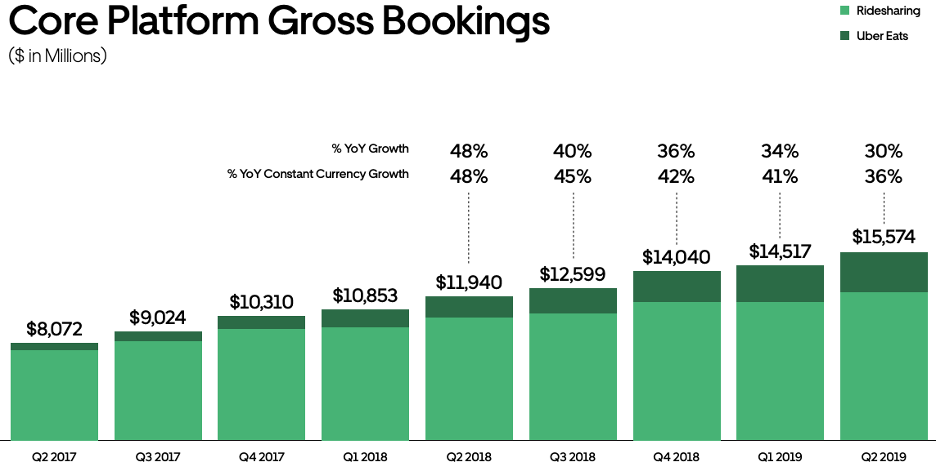

Despite promising strong revenue growth during its IPO, Uber’s Q2 2019 results revealed the slowest growth in the company's history. Core platform bookings, including ridesharing and food delivery, dropped sharply, raising concerns about its future.

Uber faced a slowdown in revenue growth, and a decline in adjusted EBITDA, and admitted it might take years to become profitable, if at all. Adding to the problems, New York City introduced a law requiring ridesharing drivers to earn at least $17.22 per hour.

Given these issues, Wall Street analysts weren’t surprised by the 10% drop in Uber’s stock following the earnings report. Barclays analysts commented:

“Given negative investor sentiment, the complicated nature of its financials, and lack of profitability, we are not surprised to see shares reacting poorly to results.”

The situation worsened as Uber’s unethical and sometimes illegal business practices came to light, further undermining investor confidence. Before its IPO, Uber was mired in controversy, including the use of software called Greyball to evade regulators, as reported by the New York Times in 2017. This software helped drivers avoid officials conducting sting operations. Uber defended the software as a measure against fraudulent bookings.

Additionally, Uber faced criticism for classifying drivers as independent contractors rather than employees, leading to a $642 million case from the New Jersey Department of Labor for unpaid unemployment insurance taxes. The company's expansion into high-growth markets like India and Brazil also drew regulatory scrutiny, with Uber acknowledging these risks in its 2019 Annual Report.

“An increasing number of governments are enforcing competition laws and are doing so with increased scrutiny, including governments in large markets such as the EU, the United States, Brazil, and India, particularly surrounding issues of predatory pricing, price-fixing, and abuse of market power.”

The controversies continued with high-profile executive departures before the IPO. Ed Baker, VP of product and growth, resigned following reports of inappropriate conduct, while Amit Singhal, SVP of engineering, stepped down amid undisclosed sexual harassment allegations. Former employee Keala Lusk exposed a toxic corporate culture in a Medium blog post, describing long hours and pervasive sexism.

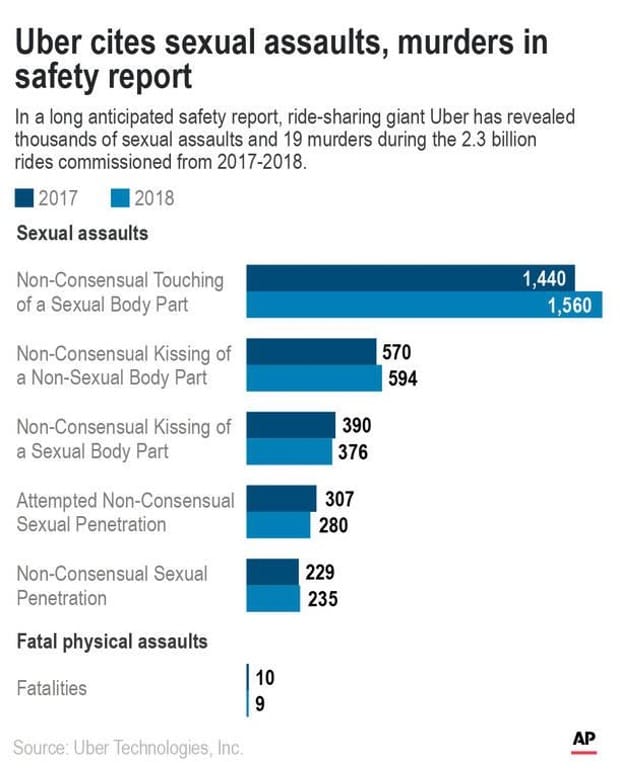

These issues culminated in a shareholder lawsuit filed in October 2021. The lawsuit also criticized Uber for failing to ensure passenger and driver safety, citing over 3,000 safety incidents in 2018, including sexual and physical assaults.

As these problems and growth slowdowns emerged shortly after its IPO, Uber’s stock plummeted, resulting in billions in losses for investors and leading to lawsuits.

Resolving The Case

To settle the lawsuit filed by the investors, Uber agreed to a settlement with the affected investors on July 22, 2024. The total cash settlement amount is up to $200 million. If you invested in Uber between May 10, 2019, and October 4, 2019, you may be eligible to file for a portion of the settlement to recover some of your losses.

Uber’s spectacular IPO and the immediate crash following its market debut highlight the risks of investing in companies that follow questionable business practices, including but not limited to deceiving regulators and misrepresenting the true growth potential.

Fortunately, under CEO Dara Khosrowshahi, Uber has made impressive progress and became profitable in 2023, surpassing Wall Street’s expectations.

Khosrowshahi’s leadership has shifted the company from reckless growth to a focus on responsible practices and a healthier company culture. A key milestone in this turnaround was Uber's recent announcement of its first annual operating profit of $1.1 billion for 2023, a significant improvement from the $1.8 billion loss the previous year. The company also reported a net profit of $1.9 billion, a remarkable recovery from the $9.1 billion loss in 2022.

This progress, along with new partnerships, reflects Uber's successful shift to a more sustainable and ethical business model, setting a promising course for future growth.

%%type:order-card,id:1294%%