Summary:

- Y-mAbs' (NASDAQ: YMAB) stock price suffered a serious blow when the FDA rejected their pediatric cancer drug "Omburtamab”.

- Investors of Y-mAbs Therapeutics, Inc. (YMAB) filed a class action lawsuit against the Company claiming misleading statements through the launching process of Omburtamab.

- The company announced a financial restructuring plan that is expected to result in a 28% operating expenses cut in 2023 and help to extend its cash runway into 2026.

- Y-mAbs ($YMAB) has announced that it will prioritize the development of its main product, DANYELZA, and the advancement of the SADA technology platform over Omburtamab and other pipeline programs.

- The European Medicines Agency agreed in February 2023 to Y-mAbs’ proposed Pediatric Investigation Plan (“PIP”) for the pediatric cancer drug "Naxitamab" (DANYELZA).

- Investors’ Expectations are cautiously in the company's favor following the new restructuring plan hoping it can set the stock back on track.

Introduction

Y-mAbs (NASDAQ: YMAB) is an early-commercial-stage biopharmaceutical company that specializes in developing new antibody-based cancer treatments. The company utilizes both conventional antibodies and its Y-BiClone and SADA platforms to create bispecific antibodies. Among its diverse and cutting-edge product range is DANYELZA® (Naxitamab), an FDA-approved drug. However, YMAB's OMBLASTYS (Omburtamab), a pediatric cancer medication, is currently in the registration stage, and its approval process has resulted in a long-standing battle with the FDA, causing a series of unfavorable financial events for the company's stock.

Omburtamab's Saga with the FDA

Y-mAbs (YMAB) developed a bispecific antibody, Omburtamab, utilizing its SADA platform for the treatment of pediatric acute lymphoblastic leukemia. The revenue for Omburtamab was expected to reach a total of $4.3bn through 2038. The company tried to get FDA approval for the drug for the first time in October 2020. However, the FDA refused to approve it because:

- the study design used by the company to test the overall survival rate of the drug was not suitable for the purpose.

- The collected data from study groups were not reliable because no statistical method can overcome the uncertainty created by the chosen study design, and

- the supportive response rate data were insufficient and included measurement errors.

The company came again in April 2022 asking for approval, but FDA denied it again. YMAB's marketing application for Omburtamab was unanimously voted against by the FDA's Oncologic Drugs Advisory Committee on October 28, 2022. As a result, investors were seriously impacted as the stock price dropped over 59%.

On October 26, 2022, the FDA raised concerns about the efficacy evidence presented in YMAB's product candidate Biologics License Application. The FDA briefing documents highlighted the following issues with the application:

- The application contained data from a single center only.

- The application was based on a single-arm trial.

- Additional FDA analyses found that survival differences could not be reliably attributed to Omburtamab. Moreover, the application lacked reliable response rate data to support the effectiveness of the Omburtamab treatment

Following this news, YMAB's stock price fell over 27%.

Investors’ Class Action Lawsuit

Following the drop in share price, affected investors were accusing the management of hiding important information and misleading statements after their statements in August 2022. In the company's report for Q2 of 2022, Y-mAbs (YMAB) assured investors that it had been involved in several “ongoing” discussions with the FDA regarding Omburtamab and that the team was “confident” it would be able to address any issues raised. The company was relying on the fact that "neuroblastoma" is an unmet medical need with a very poor prognosis which might force the FDA to approve the drug. Even if its trials are questionable. However, the FDA refused it, which caused the stock to the dramatic decline. Following these events, investors filed a securities class action lawsuit against Y-mAbs (YMAB) in the United States District Court for the Southern District of New York.

The Company is getting back on track

In January of 2023, the company unveiled a new strategic restructuring plan aimed at improving its financial situation. The plan involves prioritizing resources towards the commercialization and potential expansion of the DANYELZA drug and the development of the SADA technology platform, which stands for Self-Assembly Disassembly PRIT 2-STEP. This includes exploring further options regarding the SADA platform, such as obtaining new drugs for various types of cancer and seeking new partnerships based on the technology.

Despite having a Type A meeting with the FDA to discuss the future of Omburtamab, the company has decided to deprioritize the Omburtamab issue and other pipeline programs due to their reprioritization. To keep the cash runway, the plan also includes a substantial reduction in the workforce over a relatively short period, with 35% of the workforce expected to be laid off by May 2023. This reduction in operating expenses should result in a 28% reduction in operating expenses this year, which should be recognized in Q1 2023 and guarantee a cash flow till the beginning of 2026.

The company expects DANYELZA's net product revenue to increase to a range of $60-65 million in 2023, compared to $48 million in 2022. This increase in revenue is based on the company's estimates of the US market opportunity for the drug, which is around $400 million. Additionally, Y-mAbs (YMAB) is exploring marketing opportunities for the drug in other markets. In February of 2023, the company reached an agreement with the European Medicines Agency over their proposed Pediatric Investigation Plan (PIP) for naxitamab. This is a significant step for Y-mAbs (NASDAQ: YMAB) to penetrate the European market, as an approved PIP is a prerequisite for filing a Marketing Authorization Application (MAA) for any new medicinal product in Europe.

Financial Overview

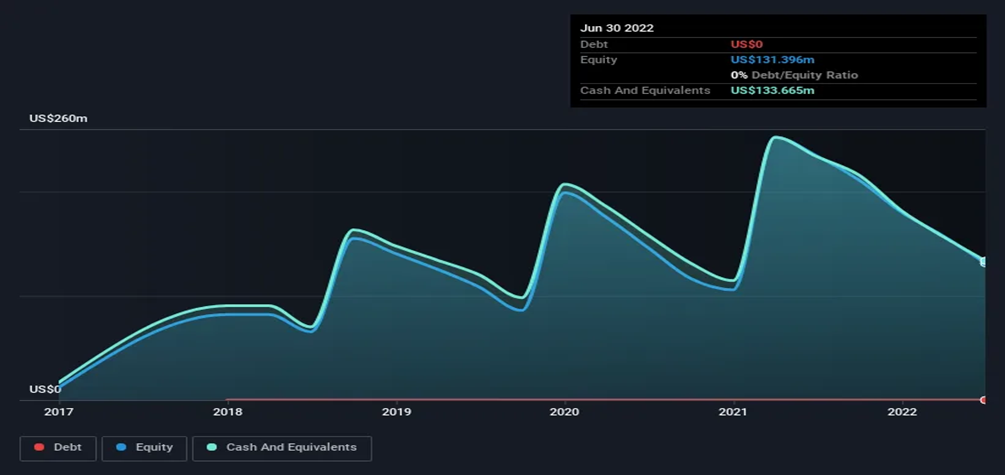

It's of prime importance for Y-mAbs YMAB) to keep a significant cash flow, keeping in mind the cash burn history of the company. Before the restructuring plan, the Company kept rising its cash burn by 8% a year.

Based on the proposed plan, the company expects a total cash burn of $50-55 million in 2023. Which is approximately more than a 50% reduction compared to 2022. Although the company burnt a lot of cash in the past few years, it can always find a way to raise more cash by issuing new shares or taking a debt. However, issuing new shares is more convenient.

The announced plan is estimated to lead to a total cash burn of $50-55 million in 2023, which is more than a 50% decrease from 2022. Despite the company's significant cash burn in recent years, it can always raise additional funds by issuing new shares or taking on debt, though the former option is deemed more convenient.

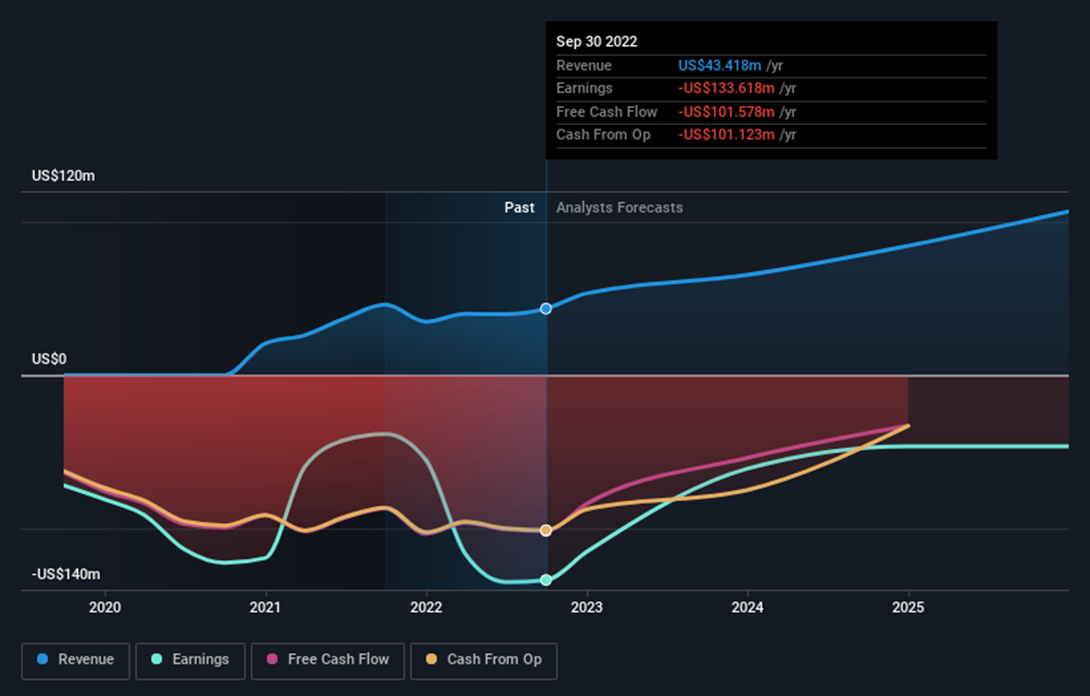

The latest report from Y-mAbs (YMAB) for the Q3 and 9 months ending on September 30, 2022, indicates that the company generated $12.54 million in revenue for Q3, up from $8.97 million in the previous year. The net loss for the quarter was $27.53 million, down from $28.86 million in the previous year.

The main risk with Y-mAbs (YMAB) shares is that the company is not currently profitable and is not forecast to become profitable over the next three years. On the other hand, according to analysts, revenue is forecast to grow 18.88% per year and it's trading at a good value compared to peers and the industry.

Conclusion

Y-mAbs Therapeutics (YMAB) was facing a challenging time in the past years. From a financial point of view, it was not profitable and was not meeting expectations at some point, which subjected it to a lot of doubts regarding its performance. Not to mention the legal situation of the company. Y-mAbs (YMAB) is facing a class action lawsuit from damaged investors, and this cast its shadow over the company's stock. However, Y-mAbs' (YMAB) management has made a perfectly timed intervention by reorganizing their priorities and taking crucial decisions trying to turn things around in near future.