In 2023, global settlements from securities class actions hit a record $8.1 billion, with $7.9 billion coming from the U.S. — an 18% increase from the previous year. Yet, on average, 75% of investors still fail to collect their fair share of these settlements.

This problem often comes from misunderstandings about how the process and distribution work. Many investors believe that filing a claim will only result in a small payout, making it seem not worth the effort.

However, settlement payouts can sometimes be even greater than the investors' losses, letting them not only get back what they lost but also gain some extra. For example, Volkswagen investors received over 190% of their losses from the settlement related to the "Dieselgate" scandal.

Such outcomes are not unusual. In other major settlements, like the $800 million settlement with Twitter and the Blackberry case, payouts also exceeded 100% of the initial losses.

A common reason for missing out on these opportunities is that many investors are simply unaware of the settlements. As a result, the funds are distributed among the few who file claims. Typically, only about 25% of investors submit qualifying claims, so the settlement money is split among them.

Additionally, the complexity of the filing process often leads to mistakes and high rejection rates. For instance, over 70% of claims were denied in the Volkswagen settlement, and this isn’t an isolated case — many other settlements have seen similarly high rejection rates. However, when claims are filed correctly, they have a much higher chance of being accepted. In fact, all the claims submitted through 11thEstate were approved.

Securities class actions are often misunderstood and can be complicated. In this article, we'll take a closer look at the statistics from five popular settlements and see how they turned out for investors.

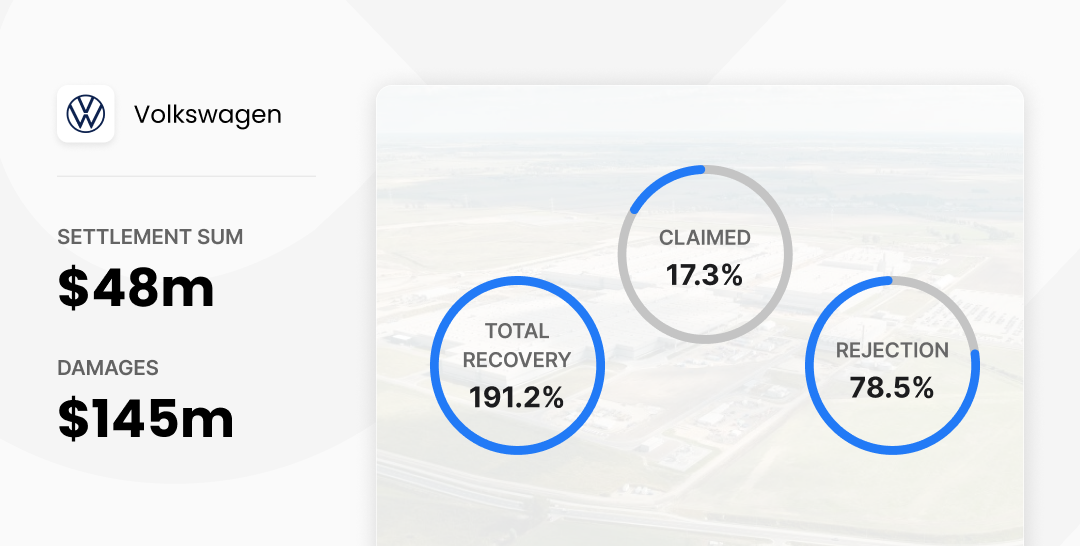

Volkswagen $48 Million Settlement

Volkswagen's case is a prime example of how securities class actions can benefit regular investors. The company settled for $48 million after the "Dieselgate" scandal, where they were accused of using software to cheat emissions tests. This scandal caused Volkswagen's stock price to drop by one-third, resulting in $145 million in damages.

A key highlight is the high recovery rate of 191.25%, indicating that investors who filed claims received almost twice their losses. Notably, only 17.31% of eligible investors submitted claims, leading to an average payout of $3,183. This resulted in outstanding compensation for those who did file, making it one of the highest recovery rates in recent cases.

However, the case also had a very high rejection rate of 78.51%. This means many claims were submitted but rejected, often due to errors in the forms. Investors with large numbers of shares frequently struggle to complete the forms correctly due to their complexity and the amount of information required, which directly impacts the rejection rate.

Despite these challenges, Volkswagen's case is a great example of how investors can end up getting more than they initially expected. In situations like this, payouts can be nearly 200% of the losses.

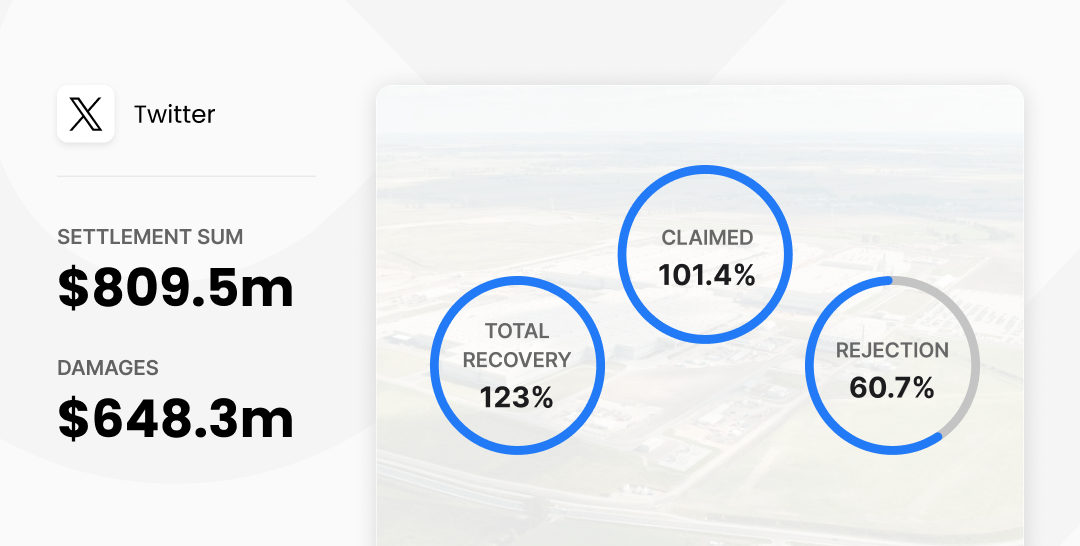

Twitter $809 Million Settlement

Another good example for investors is Twitter’s $809 million settlement, one of the largest in history, which resulted from misleading shareholders about user engagement metrics. The company had supposedly painted a more positive picture of its growth and potential than was actually true. When the truth came out, the stock price fell by 35%, causing major losses.

In contrast to the Volkswagen case, Twitter saw a high volume of claims, with the total amount of claims exceeding the $600 million in damages. Additionally, the rejection rate was lower, at 60%, compared to Volkswagen's case. Despite this, the recovery rate remained very high at 123%. This figure is impressive, especially given the widespread media coverage and the multiple opportunities for investors to file claims.

This case proves that even when many investors file claims, the payouts can be significant. The average payout in this case was $14,580, demonstrating that investors can still receive substantial compensation.

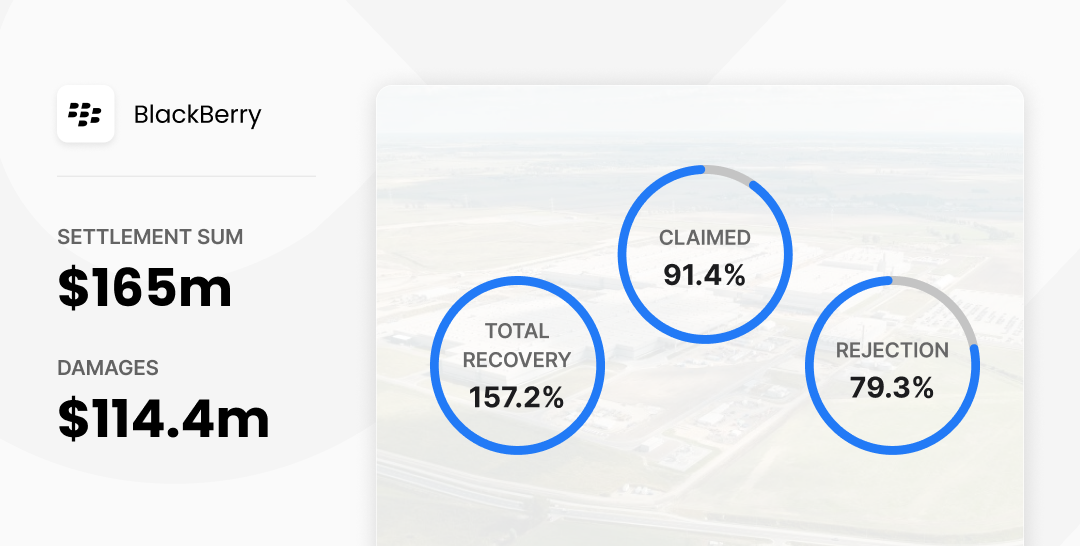

BlackBerry $165 Million Settlement

BlackBerry's case stands out with an impressive average payout of $50,754, the highest among the cases analyzed.

The case involved BlackBerry's overly optimistic projections for its BlackBerry 10 smartphone in 2013. The company assured investors of a successful product launch and high sales, boosting the stock price. However, the product didn't perform as expected, leading to significant losses for investors. In the end, the company agreed to pay $165 million to settle the case.

BlackBerry’s case also stands out for its high recovery rate of 157%. Although the claim rate didn’t reach 100%, it still shows that a large number of affected investors filed claims — over 91%.

Additionally, this case has one of the highest rejection rates at 73.01%, which may have contributed to the high average payout for those who successfully filed claims.

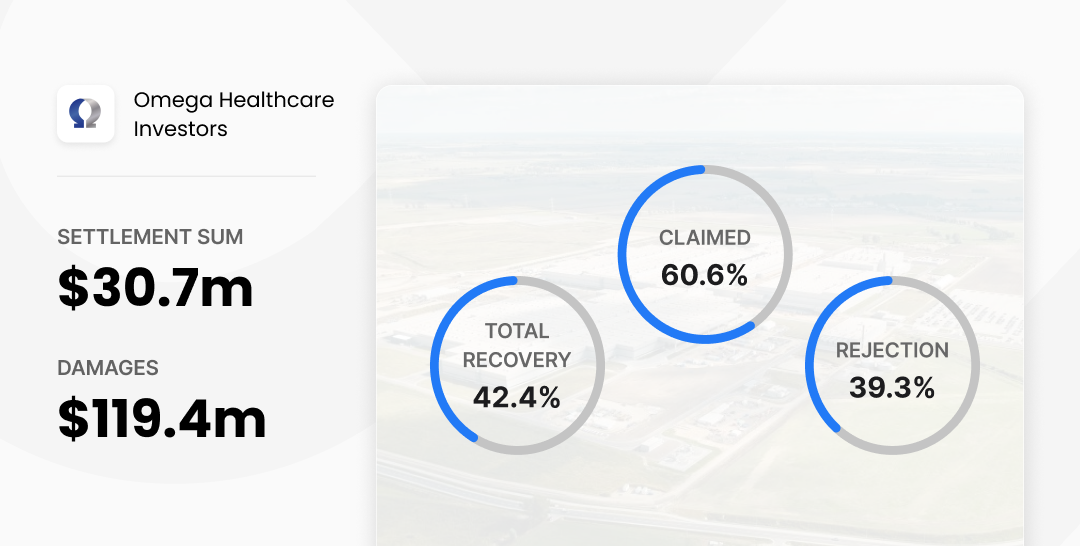

Omega Healthcare $30 Million Settlement

Omega Healthcare’s $30.7 million settlement involved claims that the company misled investors about its financial health. When the real situation came to light, the stock price fell by 6.8%, leading to losses for investors.

In this case, the rejection rate was relatively low at 39%. However, there was a noticeable drop in recovery for investors, with only 40% of losses being recovered, despite a low number of claims filed. Even so, the average payout was still $1,889, which is quite a decent amount considering the total settlement.

There were also a significant number of late claims recorded, adding up to $107,215. Many investors miss out because they don’t realize they can usually still file even after the deadline. For example, in big settlements like Twitter’s, investors could file almost a year late and still have their claims processed.

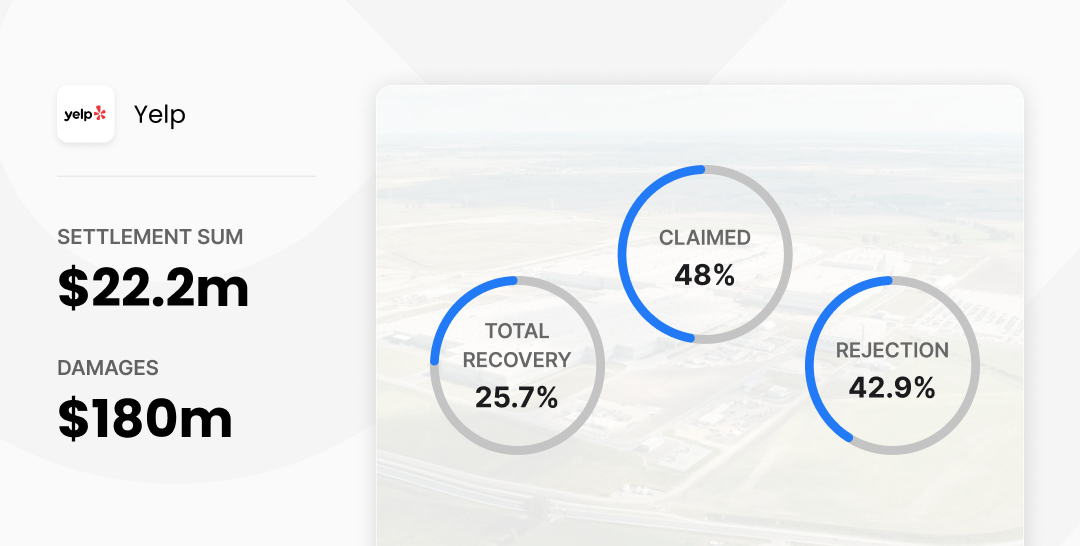

Yelp $22 Million Settlement

Another example is Yelp's settlement, where the company was accused of misleading investors about its advertising success. When the truth came out, Yelp's stock price dropped by about 25%.

In this case, the ratio between the settlement amount and the alleged damages was 12.3%, the lowest among all the examples we have highlighted. This may be partly due to the fact that 90% of investors were institutions.

Even so, investors still received an average payout of $5,208. This is a great example showing the settlement claims process results in substantial amounts of money being returned to investors.

Key Takeaways

The main takeaway is that most of the common concerns preventing investors from filing claims and receiving their payouts are either unfounded or avoidable.

We see high rejection rates all the time, which spotlights the importance of filing claims correctly. Most rejections come from preventable errors in filling out forms.

Although navigating the claims process on your own can be complicated, correctly filed claims often result in substantial payouts for investors, sometimes even exceeding their actual losses. Plus, all claims submitted through 11thEstate were accepted, so your chances of facing rejection are greatly reduced.

You can check out all the current settlements and file your claim on our website.