A common question we often get from investors is how long they should wait for their payouts. Many worry that it will drag on for years, causing some to skip filing claims and miss out on significant compensation.

However, recent data shows that many cases are resolved faster than expected. In fact, in some settlements, investors began receiving payouts just a few months after the claim filing deadline.

Let’s break down how long the process actually takes and when you can expect to receive your payment.

How long does a case typically take?

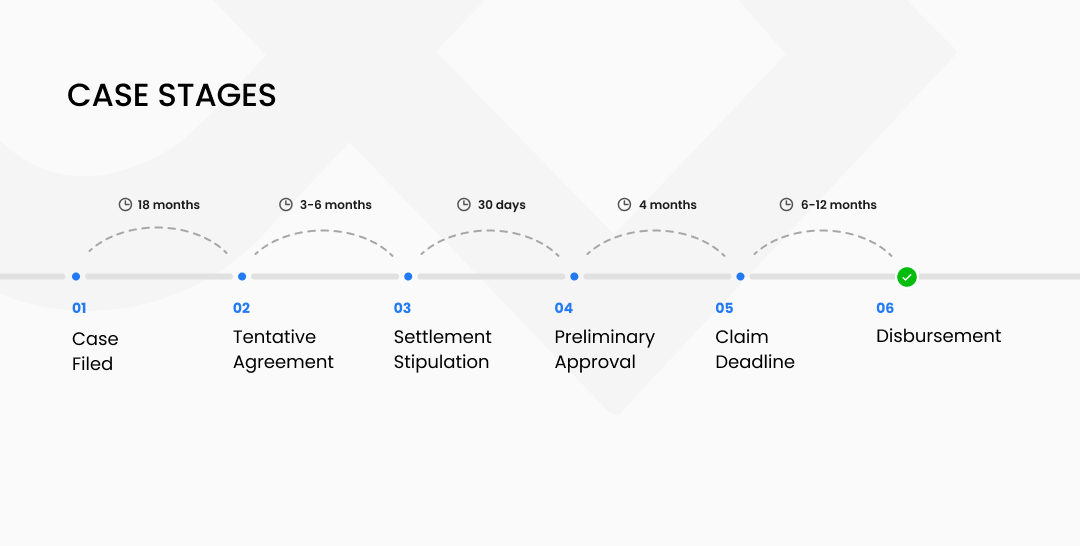

From the moment a claim is filed to the final payout, there are several key steps involved.

Here’s a breakdown of the typical timeline:

Tentative Agreement

The process kicks off when both parties agree in principle to settle the case, a stage known as the tentative agreement. While the exact details aren’t finalized yet, this marks the start of the settlement process.

At this stage, you can already submit your claim through 11thEstate.

In the past, reaching a tentative agreement could take 3 to 4 years after a case was filed. However, recent trends show this timeline has sped up, with most cases now reaching this stage in about 1.5 years.

Settlement Stipulation

After the tentative agreement, the parties work out all the specifics, such as the payout amount, the distribution process, and timelines. These negotiations usually take 3 to 6 months.

Once everything is finalized, the terms are outlined in a document called the Stipulation of Settlement, which is then submitted to the court for approval.

Preliminary Approval

The court usually takes about 30 days to review and approve the stipulation. Once it’s approved, investors are given a specific deadline to submit their claims.

Also, during this time, 11thEstate begins reviewing and verifying all of your claims.

Claim Deadline

Once preliminary approval is granted, investors usually have about 4 months to file their claims before the deadline.

It’s best to get your claim in before this deadline. However, if you miss it, you still can submit a late claim. Late claims are often accepted for several months and, in some cases, even up to a year after the initial deadline. But the final decision on whether these late claims will be accepted is up to the court.

Disbursement of Payments

The final step is distributing the settlement payments. Typically, payouts take around 9 to 12 months after the claim deadline. However, recent trends show that some cases are wrapping up faster.

For example:

- The Intrusion settlement paid out just 4 months after the deadline.

- Tufin Software investors received their payouts within 5 months.

- The Maxar Technologies case wrapped up in about 7 months.

Other large cases, like the $165 million BlackBerry settlement and the Biomarin Pharmaceutical case, saw payouts in 6 months. While some settlements still take longer, there’s a clear trend toward faster resolutions.

One thing to keep in mind: how long you wait for your payment can depend on when you file your claim. For example, if you submitted your claim early during the tentative settlement phase, you might have to wait longer than someone who submitted their claim closer to the deadline.

Why do some payouts take longer?

In cases involving high-profile companies, significant investor losses, or large settlement amounts, the process can take longer. For example, the Oracle Corporation case took about 18 months after the deadline to distribute all payments, and the Twitter settlement, one of the largest ever, required around 17 months to complete.

In summary, the timeline for securities class actions has improved significantly in recent years, showing a clear positive trend. This faster pace is also reflected in the payout process, with payments now typically issued just a few months after the filing deadline.

Currently, over fifty companies are paying settlements. You can check all of them on our website or connect your portfolio to avoid missing any you might be eligible for.

%%type:order-card,id:1137%%

%%type:order-card,id:1096%%

%%type:order-card,id:785%%

%%type:order-card,id:1294%%

%%type:order-card,id:1258%%