One of history's biggest losses has occurred in the crypto scene last week. The victim was a young crypto entrepreneur who had an estimated net wealth of $16B at the start of the week, and at the end of it, he became a poor man with his wealth gone with the wind. But as in previous cases, the real victim was not the Founders, but the entire investment community, which once again pays for ambitions and cutting corners by entrepreneurs.

The situation with FTX damaged almost all Retail and Institutional investors, not only in FTT but the overall crypto market which lost double digits billions for several days. Some Investors lost their investments in FTT. The holdings of others were blocked on the FTX Exchange. But as in the case with Terra most investors were damaged by the general crypto market downturn.

As several media reported, investors that could lose money in FTX case include such big names as Tiger Global Management, the Ontario Teachers’ Pension Plan, SoftBank Group, Sequoia Capital, Lightspeed Venture Partners, Temasek Holdings, Tom Brady, and many others.

Damaged investors already initiated and now uniting around relevant FTX Case seeking fignt back their losses.

Introduction

The crypto market has witnessed multiple turbulences in the past few months. From the Terra-Luna case, passing the spring crash of Celsius Network and Voyager Digital who filed for bankruptcy causing losses of up to $1B to the market, and finally the FTX Exchange collapse.

In the past few days, FTX Exchange and its founder, Bankman-Fried, weren't ready for the destructive chain of events that lead to the bankruptcy of one of the 2 biggest crypto exchanges in the world. Misconduct, statement wars, and misuse of capital changed one of the most successful stories into the biggest failure of the market, so far.

When did FTX start falling?

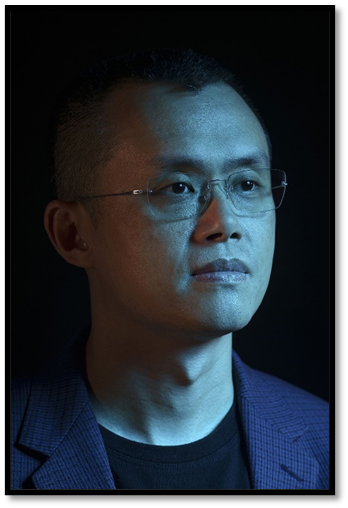

According to the recently published Case on 11thestate.com on the 2nd of November, Changpeng Zhao, the CEO of Binance, was in Lisbon attending the annual Web Summit, and he started talking about volatility in crypto, in a try to convince investors of the risk in the crypto trade. At the same time, the crypto news service, CoinDesk, announced claims regarding the sheets of Alameda Research, a crypto trading company owned by Sam Bankman-Fried and is connected to FTX. The claims were saying that Alameda was holding billions of dollars worth of FTX'S token, FTT, using it as collateral in its lending operations. This means that if FTT falls, Alameda falls too. Until now, everything was in hand and the sayings were not more than rumors. The big action started on Sunday, the 6th of November when Zhao decided to liquidate Binance's FTT holdings that they gained after their exit from their equity with FTX in 2019. It was worth $2.1B back then and now it's about $550M. Zhao justified his company's actions by tweeting this: "Due to recent revelations that have come to light, we have decided to liquidate any remaining FTT on our books." He said that he isn't trying to hurt anyone, and the thing is they now want their money back because of "Limited liquidity" in the market.

These actions opened a stream of withdrawal requests from FTX users worth billions of dollars. The requests were more than the capacity of FTX, which in turn forced FTX to suspend any withdrawing requests starting from Tuesday.

But where did the Clients' money go!?

FTX is based in the Bahamas, which is more open to some practices than the United States. In the Exchange platform that operates in the Bahamas, a user can borrow crypto and bid on how the crypto price would be in the future, which is prohibited in the U.S., and this is how Alameda research works, in a similar way at least. FTX's branch in the U.S. is doing only normal crypto trading and takes commissions on the trade, that's it.

When the big withdrawal move started, Bankman-Fried made a meeting with some FTX executives to see how much money the company needs in order to cover the shortfall. According to people familiar with FTX's finances, the spreadsheets in the meeting revealed that Mr. Bankman-Fried had made a transfer to Alameda from FTX's client funds worth $10B. Among those $10B, there were $1 to $2 Billion was not known which exactly they got used or how, and this money wasn't in Alameda's spreadsheet also.

After some digging, the legal examination showed that Mr. Bankman-Fried made a "back door" in FTX's bookkeeping system. This back door allowed him to do some alterations to the company's finances without letting anyone know what he was doing. According to Reuters, Mr. Bankman-Fried denied doing such a thing. The difference of $1 to $2 billion is what's making life difficult for FTX and forced Sam to find a buyer to rescue him from this hole.

How Binance gave a K.O. to FTX?

The rescuer that Bankman-Fried wished for turned out to be Zhao. The provisional deal between Binance and FTX was announced on Tuesday, 8th of November, only 2 days after Binance's withdrawal. Bankman-Fried confirmed the deal on Twitter by saying: “Things have come full circle, and FTX.com’s first, and last, investors are the same: we have come to an agreement on a strategic transaction with Binance for FTX.com". That was exactly what Sam hoped for to get out of his problem, but sadly it didn't end well. On the very next day, November the 9th, Zhao suddenly pulled off from the deal leaving FTX and Sam to face a dark future.

“In the beginning, our hope was to be able to support FTX’s customers to provide liquidity, but the issues are beyond our control or ability to help,” Binance said in a statement. Zhao tweeted after that saying: "sad day"

Is Bankman-Fried still on top of FTX?

On Thursday, the 10th of November, Sam has come to his senses and decided to face the bitter truth. He tweeted that he "Fucked up and should've done better". On the next day, FTX filed for bankruptcy protection in the US, including its US platform and Alameda. The company appointed John Ray III as the new CEO, replacing Bankman-Fried. John was already known for his high liquidation skills as a lawyer when he managed to liquefy the fallen energy giant Enron years ago. As for the people's money, it's hard to say that they're closer to getting it back instead of losing it. Now the SEC and Department of Justice are investigating FTX's situation.

Did Zhao plan all of that?

Well, it could be a possibility, especially since Zhao warned about a 2008-like crisis just hours before the official bankruptcy announcement. Bankman-Fried and Zhao were already a tough market rivalry, and both of them didn't agree on the same code apparently. Bankman-Fried was in the quest of trying to alter the regulations to be in his favor by spending millions of dollars funding US Democrat politicians and lobbying for closer regulation of crypto trading in Washington. Which was an action that really made Zhao angry to the point that he mentioned it in one of his posts saying: " we won't support people who lobby against other industry players behind their backs". After Zhao's Sunday tweets, Bankman-Fried responded on the next day saying that " a competitor is trying to go after us with false rumors" and that "FTX is fine" along with its assets.

Crypto now is getting one of the hardest times in the history of the industry, major turbulences are happening now, and all that drama has laid its shadow over the rest of the market. The major coins are dipping, and people are afraid to invest in such a risky field, especially during the harsh times the world is seeing.

FTX's Bankman-Fried and Binance's Zhao rivalry in chasing dominance led to the overall crypto market losing billions for several days. Will be able Crypto Investors to defend their interests this time?

%%type:order-card,id:438%%

%%type:order-card,id:453%%

%%type:order-card,id:281%%

%%type:order-card,id:257%%

%%type:order-card,id:258%%

%%type:order-card,id:261%%