At different stages of life, a person’s environment and content are changing dramatically depending on goals and priorities. For example, in youth, a person strives to participate in and observe a large number of activities, it is the time for studies and self-fulfillment. Open-minded friends are great for such purposes. But 30 years later, when such a person has a family, a home, and a career, he or she prefers interactions with colleagues and neighbors, becoming more conservative and taking special care of their reputation. The same can be said about companies. At the startup stage, management must be dashing to overcome all barriers and make the company an industry leader. Behind the success of most of the largest companies in the United States, there is an individual with an outstanding personality who stood at its origins and led it to the very top. Who knows what the operating system market would look like without Bill Gates - maybe people with PCs would choose from 11 similar “windows” or maybe everyone would just own MacBook.

Change of priorities.

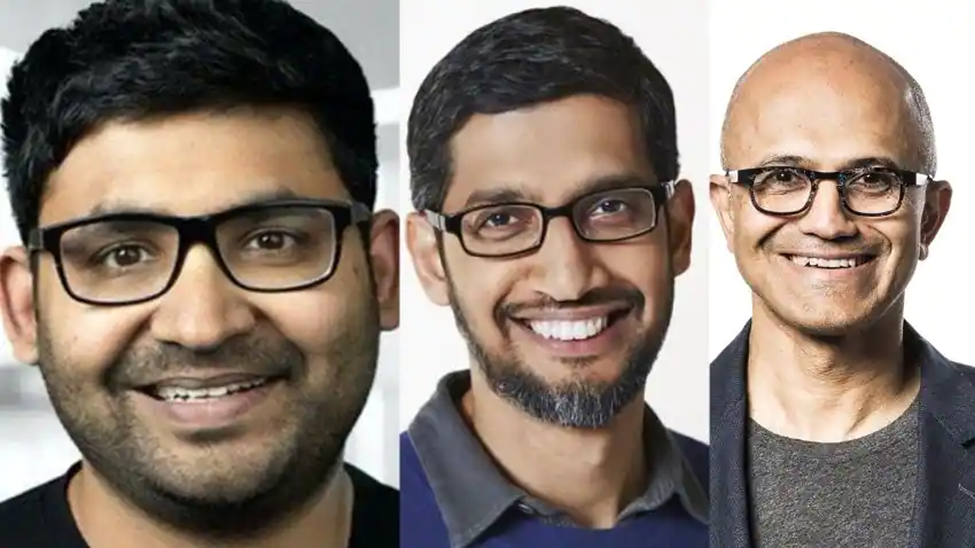

With the growth of the business and the transition to the status of an industry leader, the company begins to face completely different tasks and challenges. There are not many new products and markets, so it is necessary to maintain internal organization, solve corporate problems and optimize. Undoubtedly, people can also evolve with the company, and develop new skills and competencies. Yet, often different personality types are needed for different stages, so it might be difficult for an aggressive startup manager to optimize operating costs. There are many examples when the company founders handed over the reins to "professional CEOs", and the business reached a new level. Sundar Pichai at Alphabet and Satya Nadella at Microsoft (MSFT) are good examples, and Parag Agarwal also got off to a great start at Twitter (TWTR). The companies’ founders who can move on to pursuing stimulating new challenges and initiating new projects have also benefited from such transitions.

King's overthrow.

Where there are positive examples, there are always opposite ones. You don't have to look far, the first iteration of Gates' replacement at Microsoft (MSFT) was not so successful. And now let's think about what would happen if the founder of the company can no longer cope with responsibilities at a new stage of the company’s growth. Here we also have a great example. In 2009, Travis Kalanick together with Gareth Camp created Uber (UBER), and the following year Travis took charge of the company. His work is associated with the rise of the company, global expansion, and worldwide recognition. However, he left the company before the IPO in 2019, and later sold almost all of his shares. The reason for leaving was a failure in corporate affairs, the company was mired in scandals that Kalanick did not want to deal with. Sexual harassment, database leaks, patent litigation, all this is a job for a professional manager, not a genius and innovator. Echoes of serious problems in the company's corporate governance are heard to this day in the form of investigation Cases against Uber. Most likely, in the modern world, many of the most successful businessmen of the past would have been targeted by the cancel culture for their harsh working approaches. That is why it is important that after the company goes public, there should be an "infallible" leader at the top.

A dog in the manger.

Most often, with a small share of the capital, the founders' shares with a large number of votes, so it is almost impossible to oppose their power. Also, investors may be hesitant to change top management because of the emerging uncertainty in development, or out of respect for their past achievements. In these situations, high risks of deterioration in the quality of management may arise, for example, due to the manager’s attention to outside projects. Jack Dorsey is known as the founder of Twitter (TWTR) and Block/Square (SQ), while the social network was his "firstborn", and it was showing excellent results until a project more interesting for the manager came along. While Square (SQ) was growing at an unprecedented pace and kept launching new products, Twitter (TWTR) was increasingly lagging behind its competitors and losing its appeal, yet only at the end of 2021, Jack gave up the CEO chair. But some people can combine several posts at once. Elon Musk is a good example, simultaneously developing Tesla (TSLA), SpaceX, and several other projects. But in this case, there is already a fear not for the company, but for the person himself, as to how long will he withstand this pace and when will he start making mistakes? Maybe his last deal with Twitter (TWTR) was the first glimpse of that?

When is it time?

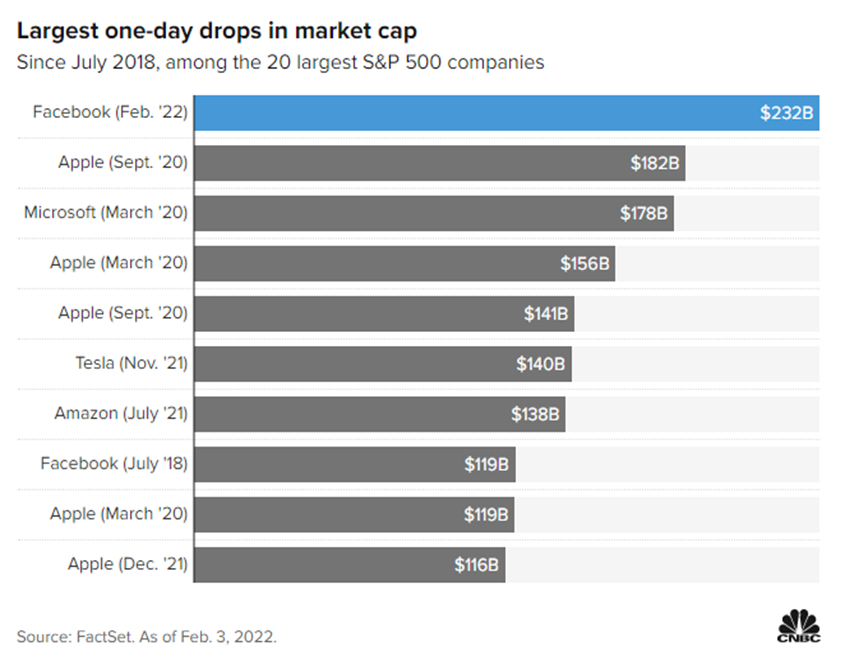

But how do you know that it's time to leave your company and move on? This is the most difficult question, let's look at a fresh example. Recently, Mark Zuckerberg, CEO, and founder of Facebook (META) has been under a barrage of criticism. One of the most successful businessmen in history is fighting off accusations from the authorities, society, investors, and employees. The government is concerned about the influence the media giant has on political processes, from providing a platform for organizing uprisings and conflicts in India, Myanmar, and Eritrea to coordinating the January 6 events at the Capitol. Society is dissatisfied with many aspects of the company's work, in particular, the ineffective fight against misinformation during the pandemic. Investors are dissatisfied with the company's new development strategy, which had led to a new negative record for a public company’s one-day drop in capitalization. Focusing on the development of metaverses requires large expenses with a very distant prospect of payback, while the current business suffers, being greatly outpaced by TikTok. Employees are also dissatisfied with the strategy, the best specialists are pulled out of other projects to be involved in a meta-project, there is no clear plan, but only a general concept.

It looks much like the situation with Jack Dorsey in terms of switching priorities, only Mark Zuckerberg started a new project inside the old company and at its expense. Perhaps this project will become a new gold mine and will bring the whole company to a new level, but here and now investors of one of the largest companies in the world want the shares to behave like a blue chip, not a startup. Therefore, it would be more logical to split up the companies and allow riskier investors to invest in a breakthrough project, rather than asking conservative Facebook (META) investors to fund the uncertain Meta project. As for scandals, there is already a direct similarity with Kalanick and Uber (UBER), and solving the problems requires the undivided attention of the top manager, with the appropriate skill set. For now, it seems like the CEO is not handling it.

On October 26, 2022, Meta Platforms (META) reported a decline in quarterly revenue and climbing costs related to the unit, Reality Labs. On this news, Meta stocks dropped over 20% and the Company lost more than $ 70 billion of its capitalization. This is not the first quarterly report that disappoints investors. The ambitions of Meta's Founder and CEO for metaverse projects are becoming less and less popular among investors, and the company's shareholders have to pay for it, losing billions.

What could we as investors do?

In the Meta (META) situation the CEO has the majority of votes, so investors do not have an option of protecting their rights through a shareholders' meeting. Their only recourse may be an attempt to prove poor management of the company or violation of fiduciary duties in court. However, for the lawsuit to have a chance of success, it must involve a large number of shareholders and ask for tens of billions of dollars in damages. How can so many investors join together in a cause? 11thestate platform was started specifically to deal with this type of issue. It unites the entire investment community into a formidable new force that negligent managers will have to reckon with.

%%type:order-card,id:424%%

%%type:order-card,id:108%%

%%type:order-card,id:97%%

%%type:order-card,id:41%%

%%type:order-card,id:44%%

%%type:order-card,id:114%%

%%type:order-card,id:241%%

%%type:order-card,id:166%%

%%type:order-card,id:133%%