Why do people invest? It would seem to be a very simple question. Most will answer, and they will be correct, that they intend to increase their net worth. But there is another very important type of investment – investing in your future. In the early days of Tesla, very few people believed that Elon Musk would ever be able to achieve profitability, let alone build one of the biggest companies in the United States. Then he offered to use the company's patents free of charge so that others would also start making eco-friendly cars. Another example of investing in the future with minimal chances of financial return is the development of drugs for neurodegenerative diseases. Most clinical trials fail, and the process costs billions of dollars, but people still continue to work on it. For example, one of the best-known funds to fight against Parkinson's disease was founded by the famous actor Michael J. Fox. Why does he, as well as many others, do this? That's correct, they want to make their lives and the lives of other people better.

Capital augmentation.

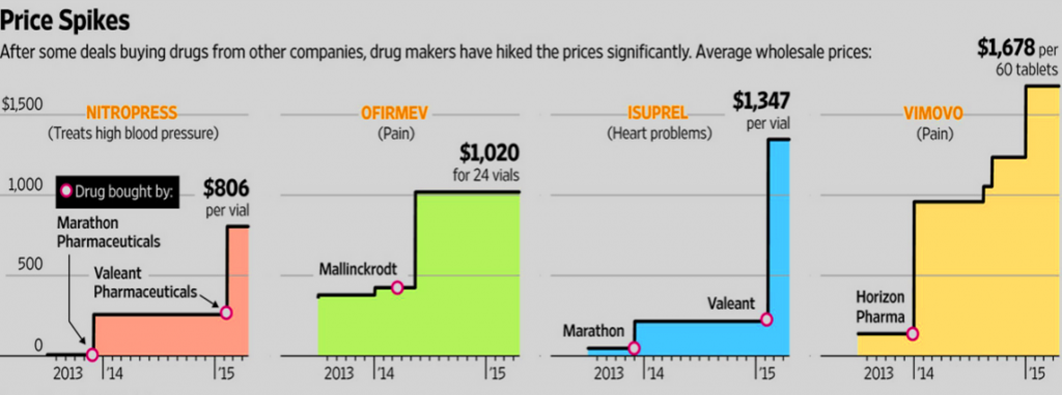

Now, let's return to the basic purpose of investment – making money. There is nothing wrong with wanting to earn, in any case, these earnings can be spent on non-profitable charitable projects, as Warren Buffett and Bill Gates do. But what happens if the goal of earning is not restrained by any barriers and laws? If there were no trade unions and labor protection laws, then, to increase profits, companies would make employees work two shifts, while paying the minimum wage. If there were no environmental laws, then chemical production companies would not have to spend vast amounts to neutralize the negative consequences of their activities for nature and would just dump waste into the ocean. If there is no antimonopoly legislation, one largest company would be able to buy up or strangle all its competitors and dictate its terms to the whole world. All these barriers emerge through evolution since without them the balance would be disturbed. From the recent events, we can recall the "golden age" of the biotechnology sector during the first half of the 2010s. It was called golden not because of the rapid development and breakthrough technologies, although this is also true, but because of the sky-high prices for medications. Companies such as Valeant acquired patents for certain drugs and raised the selling prices for these drugs by hundreds and thousands of percent, as patients had no choice but to pay. Legislators are still in process of constructing an effective barrier against such abuses.

Substitution of Concepts.

To summarize, we can conclude that the state can regulate business activities in all important areas, and the business’ top management should act in the best interest of investors within the framework of legislation. This is what investors want from the company they invest their money in. The business should grow as fast as possible, or the maximum funds should be returned to shareholders through dividends if there are no opportunities for growth at the moment.

In such circumstances, the recent years’ trend of ESG investments looks undeniably illogical. All companies must comply with the mandatory terms and conditions in all areas, but proponents of the ESG concept demand stricter restrictions and increased spending. Still, if more restrictions were required, there is no doubt that the government would have introduced them without relying on somebody’s good intentions. No company starts paying more taxes to help the country's economy until these taxes are raised by the government, so why should they act to their own financial detriment where it is not mandated?

Mismanagement.

The desire of management to do good deeds is quite understandable and commendable/ But do managers have the right to make such sacrifices at the expense of shareholders who expect them to manage their business effectively and efficiently? The investors themselves have a choice to donate money to a good cause or buy an ESG bond with a smaller coupon than its equally reliable counterpart. When the management of a company starts doing something other than their job, investors lose money. Just imagine if the management of British American Tobacco concerns itself with the health of its consumers? They will have to shut down the factories and financially hurt their investors. And the developers of breakthrough technologies in the field of gene therapy or cellular immunotherapy of cancer? If they start distributing their drugs free of charge, they will not have sufficient funds for new tests and research. Unfortunately, nowadays the poor quality of company management has become commonplace, while many hide their incompetence behind loud slogans and good-looking signs.

Sanctions case.

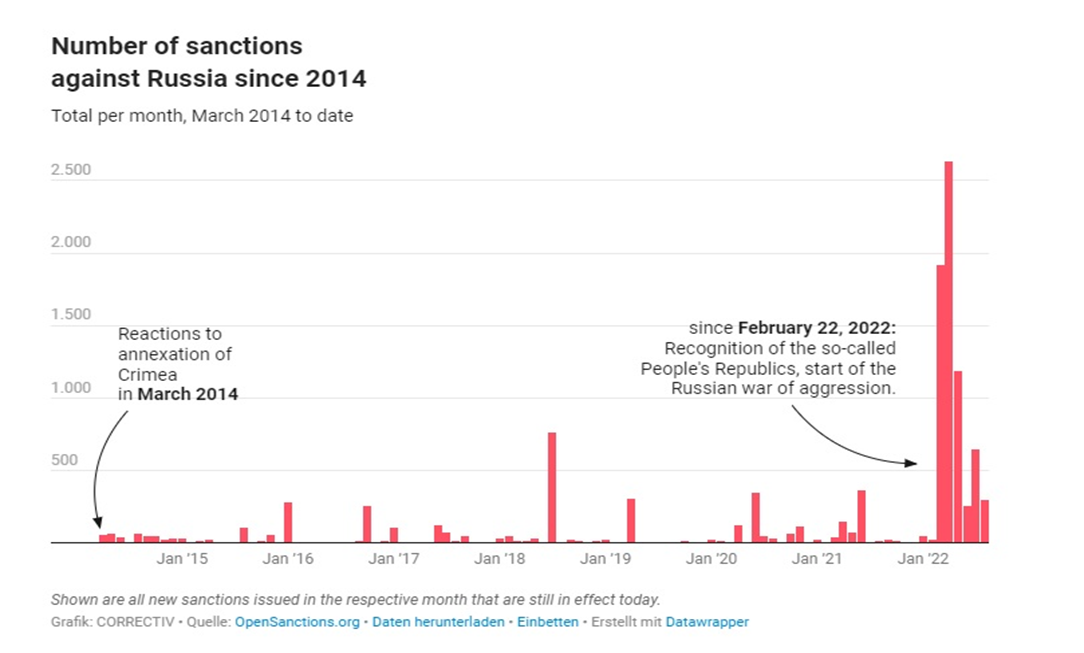

Everyone is aware of the terrible events in Ukraine, where innocent people are dying every day. The US and other governments have imposed several packages of sanctions against Russia to stop what is happening. The restrictions apply to the defense sector, finance, officials, and businessmen close to the President of Russia. At the same time, restrictions are not imposed on those sectors where they would contradict humanitarian norms. Medicines and essential goods that are not related to the fighting and are intended for ordinary people, continue to be supplied to Russia. There are also no restrictions on the supply of fertilizers and food from Russia since the country is the largest exporter and without its resources, there will be famine in the world. At the same time, there is no doubt that governments are doing everything possible and have imposed the restrictions that should have been introduced.

Netflix and others.

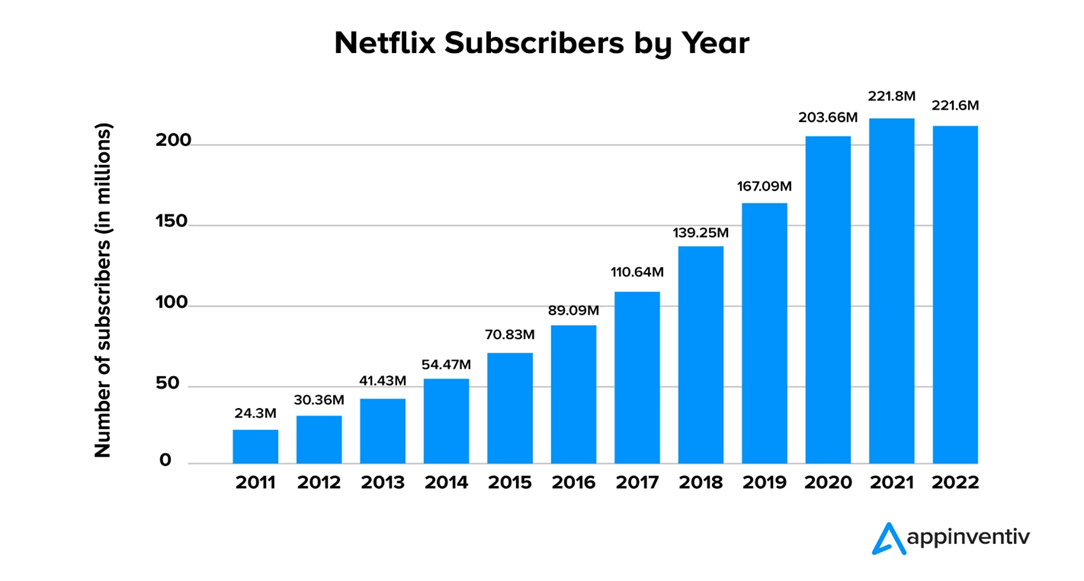

Following the ongoing events, many companies have begun to wind down their business in Russia or sell their units to local players. For some, the continuation of operating activities became impossible due to the disruption of logistics, for others, the trigger was the company's activities falling under sanctions restrictions. But there were also those whose departure cannot be explained by any logic. Netflix was one of the first to announce its withdrawal from the Russian market despite the fact that the company's products in no way affect the events taking place in Ukraine. Moreover, Netflix content is aimed at the young Russian audience and promotes Western values in Russia. From a business point of view, the company shot itself in the foot, the 1st quarter of 2022 becoming the first quarter since 2011 when the number of subscribers of the service decreased. And in the second quarter of 2022, the number of users canceling their subscriptions increased to 1 million. All this has had a disastrous effect on the company's shares, which have declined more than 60% since the beginning of this year.

The list of companies that have taken upon themselves the right to administer international justice is quite long. McDonald’s lost more than $1 billion on the sale of their restaurants to local players. Given the full localization of production on the Russian market, and the food industry being part of non-sanctioned sectors of the economy, this decision made no sense. Moreover, the company experienced difficulties with maintaining growth rates, and after this demarche, it is unlikely to return to the Russian market. Does it make sense for Coca-Cola, Visa, Apple, Disney, Starbucks, Spotify, Adidas, and others to leave? It hardly does, rather these are further examples of management overstepping their authority and in doing so, not acting in the interests of the shareholders, thus reducing the value of their investments.

The 11thestate platform is designed, among other things, to remind management of their responsibilities, to improve the quality of corporate governance of public companies, as well as to protect the investments of ordinary people.

%%type:order-card,id:342%%

%%type:order-card,id:290%%

%%type:order-card,id:340%%

%%type:order-card,id:238%%

%%type:order-card,id:299%%

%%type:order-card,id:265%%

%%type:order-card,id:179%%

%%type:order-card,id:202%%

%%type:order-card,id:212%%

%%type:order-card,id:214%%

%%type:order-card,id:40%%

%%type:order-card,id:294%%

%%type:order-card,id:128%%