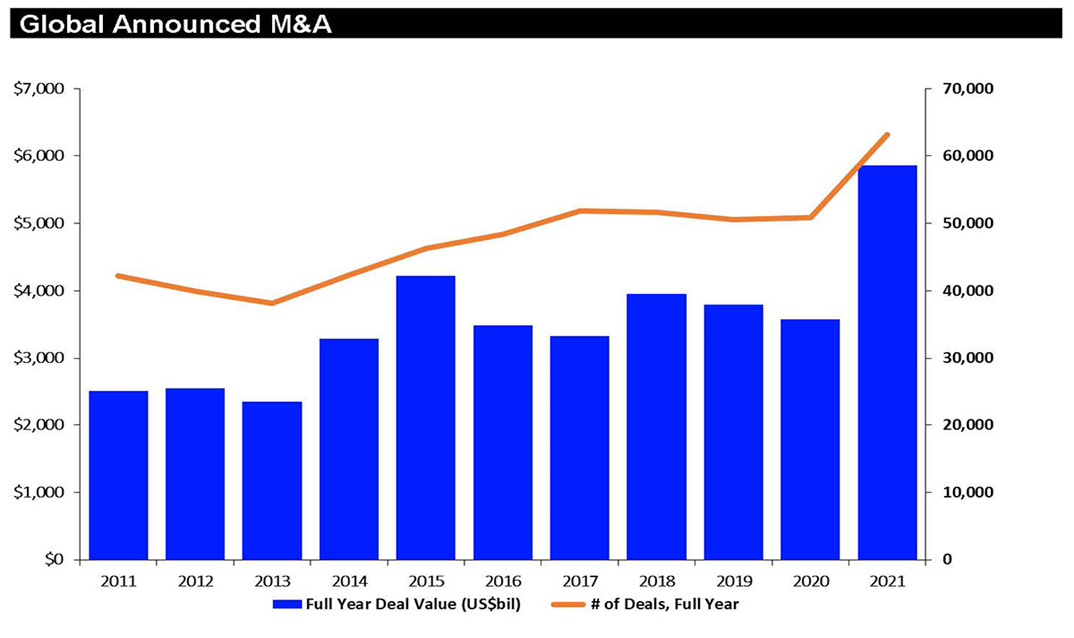

Mergers and acquisitions are an integral part of the business strategies and the stock market. Large companies buy small ones, medium-sized ones unite into industry giants, and there are even such deals when a small company "buys" a large one, these tricks used to be employed to change the tax jurisdiction. Such deals are always noticeable, and their prevalence and impact on the economy are only growing. Last year, a record was set for the number and volume of M&A deals, more than 62 thousand transactions were announced globally for a total amount of $5.9 trillion, including 130 large transactions with a volume of more than $5 billion each.

A significant part of the acquisitions involves private companies, where the valuation can only be discussed in terms of multipliers. But with public companies, everything is much simpler, as an ordinary investor is primarily interested in the price of shares and the premium to the market price that the buyer is willing to pay. For example, in the biopharma sector in 2021, for the top 5 largest deals, premiums ranged from 33% when Merck (MRK) bought Acceleron Pharma to 100% in the Pfizer (PFE) - Arena Pharma deal. During the news release, the shares instantly rise to the buyout price, from which it can be assumed that M&A is the best event for an investor, but is it really true?

An outside view.

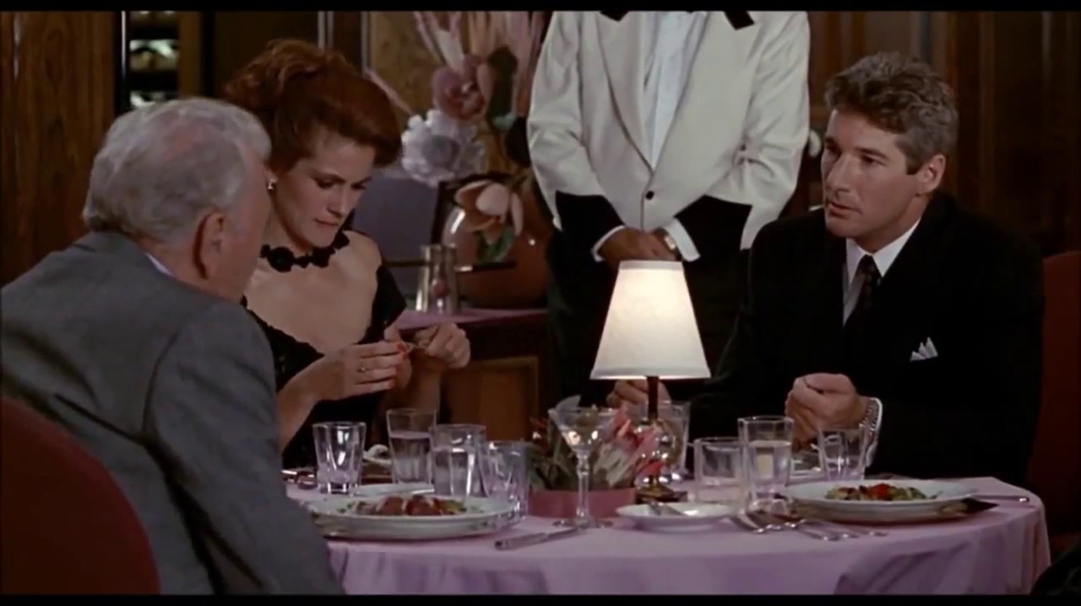

In the view of the general public, the attitude towards M&A has always been ambiguous. For example, in the movies, such transactions are generally depicted in a negative light. Let's recall the movie "Pretty Woman" starring Richard Gere and Julia Roberts. The movie’s main character is engaged in buying up companies in a difficult financial situation and then sells them off for parts. From the point of view of the founders and management of the company, this is the loss of their life's work. By the end of the movie (Spoiler alert) the hero reforms and decides to save the sinking company. But if you look at it through the eyes of an ordinary investor who holds shares to make money, and not to satisfy someone's need for self-realization? It is undoubtedly more profitable for such an investor to sell shares during an unfriendly takeover than to wait for bankruptcy.

Also, large companies often use their financial resources to buy potential competitors. For example, before the green energy boom in the last decade, most of the innovative companies in this area were owned by the oil giants, who were being accused of intentionally restraining innovation. But what is bad for the environment and the average person is good for the investor, in such transactions the buyer usually paid the highest price.

Fair price.

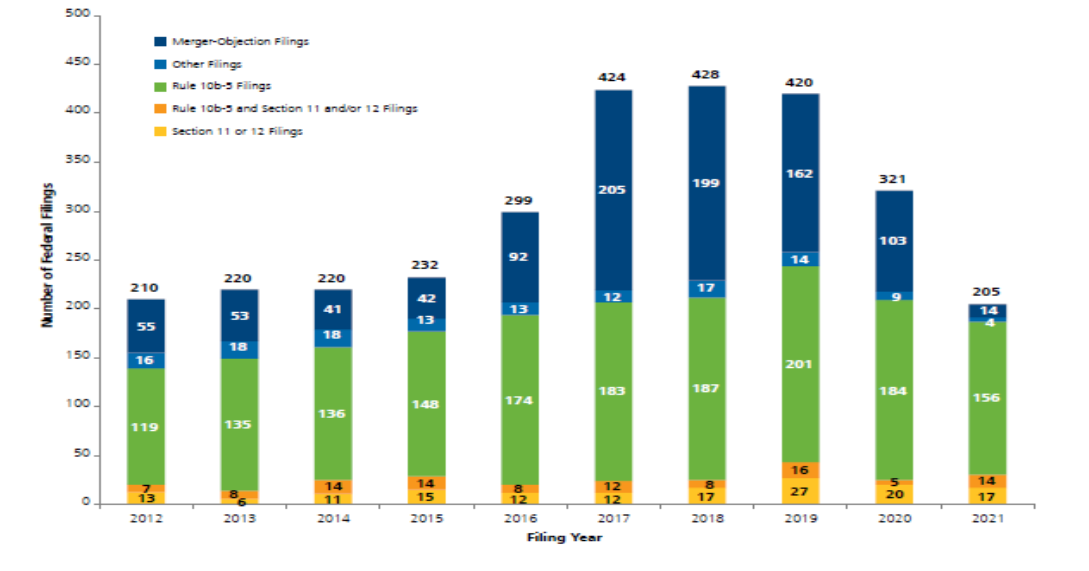

Another question is whether such transactions are always made at a fair price and are beneficial to shareholders. There are many examples when a company's shares are significantly declining due to a one-time event (poor reporting), temporary difficulties (failure of the logistics chain due to Covid), or a bad situation in the stock market (this year’s correction). Is it profitable for investors to sell shares with a 50% premium if the shares were 100% more expensive this year? It depends, among other things, on whether the shares could have recovered by themselves, and how long it would have taken them. You may be surprised, but a significant portion of federal securities lawsuits relate specifically to M&A.

For a successful M&A transaction, it is vitally important to accurately assess the benefits of the merger, the prospects and risks of the business, and also not to overpay. This is quite a difficult task, even without taking into account inevitable obstacles. The fact is that when selling any product, the seller strives to present it in the most attractive light and hide its shortcomings. When selling an apartment, you will spruce it up to hide cracks in the walls, which the buyer will only find out about after moving in. Similarly, when selling a company, management can distort the outlook of the company's finances through window dressing. Examples include postponing payments to suppliers for several quarters, accelerating turnover through related parties, and using the most favorable method for determining important operational indicators, there are plenty of legal ways. In M&A transactions, such tricks will quickly be revealed, since before the purchase, the company's finances are checked (due diligence), therefore, such tools are more often resorted to before IPOs, rather than acquisitions.

At the same time, it is important to note that the shareholders of the buying party may be more dissatisfied with the deal if they decide that their company is overpaying. Some of the clearest examples of terrible deals are the purchase of chemical giant Monsanto by Bayer (BAYN) and the purchase of Allergan's generic business by Teva Pharma (TEVA), from which the companies still cannot recover. As an example of the opposite, we could mention an extremely profitable purchase of YouTube by Google (GOOG), or of Instagram by Facebook (META).

The Twitter Case.

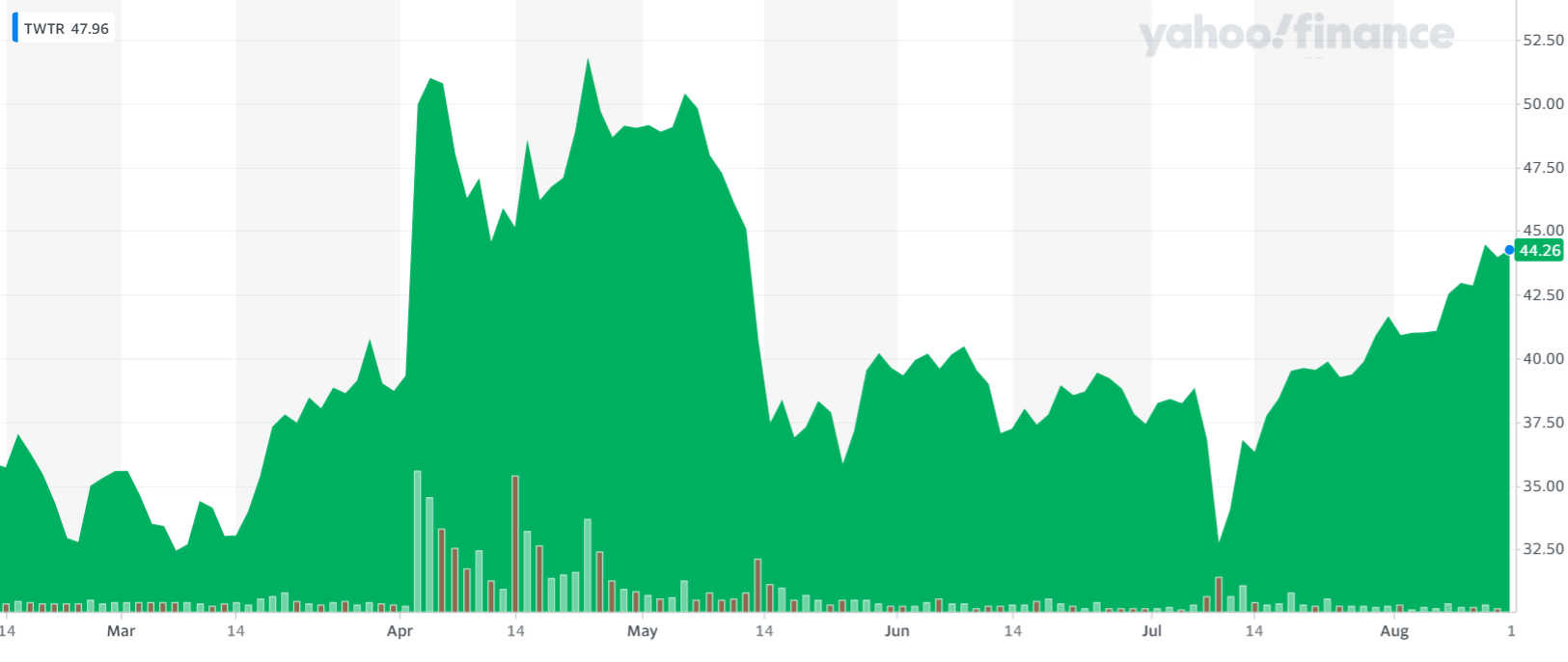

One of the most high-profile deals of recent times is the failed buyout of Twitter (TWTR) by Elon Musk. At first glance, the purchase price was 1.5 times higher than the levels at which the company was trading when Musk started buying up its shares, thereby starting a reversal trend. But should the shareholders be happy?

Immediately after the news of the potential buyout first surfaced, the company's Board of directors began taking steps to counter the hostile takeover, and one of the largest shareholders claimed that the company should be worth much more. Indeed, even over the preceding 12-months period, the company had been for long-time trading significantly above the price that Musk had offered.

From the operational perspective, the case is also quite interesting. Under the management of the company by its founder Jack Dorsey, the indicators were significantly inferior to other major social networks, but at the end of 2021, he resigned. Parag Agrawal became the new CEO, and it was his innovations that led to the growth of the active user base (mDAU) from 1,15 million at the end of 2017 to 217 million by the end of last year. Parag has announced a rather ambitious development strategy which is currently at the initial stage of its implementation.

And finally, the decrease in share price at the beginning of the year coincided with the correction of the stock market in general and in the technology sector, in particular. Let’s agree, that this situation looks ambiguous. Stranger yet is the fact that just a few days later, the Board of directors of the company changed their mind and agreed to Mask’s terms. Usually in negotiations, the refusal of the Board of directors is followed by an increase in the offer price by the buyer, and then the parties can strike hands, but in this situation, it appeared like the Board had accepted the ultimatum. Did public pressure and threats to sell off your stake influence the decision? It's up to you to draw conclusions.

After reaching the agreement, Mask unexpectedly put the deal on hold and later canceled it, subject to verification of the percentage of fake or spam accounts. As we have already noted, some companies may embellish their indicators to raise the company valuation. In this case, during due diligence, this may be revealed and the buying party will demand a revision of the price or cancellation of the transaction without penalties. The problem is that Twitter (TWTR) was not for sale and did not mislead anyone, Elon Musk attempted an unfriendly takeover and the price he offered did not depend on the number of bots and spam accounts. Now the scandalous businessman is trying to avoid the deal since the prices of technology companies in the market have been greatly adjusted and there is a possibility of a deep economic crisis. This time, those investors who bought shares in the hope of a deal were defrauded.

Other interested parties.

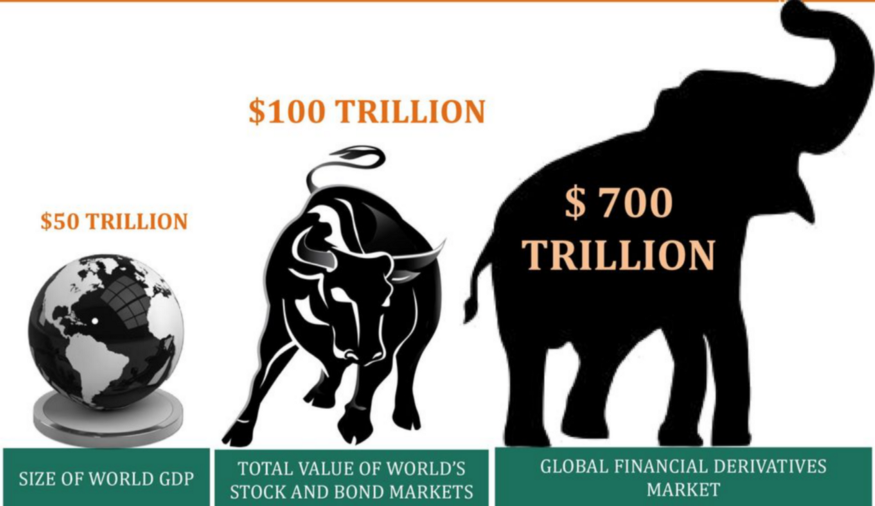

We talked about the interests of shareholders, consumers, employees of the company, and even the founders. It seems that the list is full and we can stop here. But we didn't see the elephant behind all this. The derivatives market has long been one of the whales of the financial world. Its estimates differ, for example, according to one of them, this market exceeds $600 trillion, which is 30 times the US Gross Domestic Product. At the same time, M&A transactions lead to significantly larger movements in this market than in the regular financial market.

Let's take a look at the Twitter (TWTR) case. People with a short position on stocks, holders of PUT options, and several other instruments suffered huge losses. But was it a fair game? According to SEC rules, upon reaching 5% ownership of shares by one beneficiary, it must disclose this information. But Elon Musk submitted such a report only when he already owned 9.2% of the shares. We can say that in the case of disclosure of 5% ownership, the shares would instantly jump up, so those who had already bet on the fall of the shares would have suffered and received their losses in any case. But there remain those players who actually made this bet after the cutoff, when, according to the law, the information should have been published. Had they had this information, it is unlikely that any of them would deliberately put themselves in the position to incur such losses.

Hence the question arises, why was the information not disclosed on time? There are many examples when the SEC allowed the buyer to delay such disclosure, including when such an exception was made for Buffett. Does the state body have the right to infringe on the rights of some investors in favor of others? Or have they forgotten about investors in derivatives?

TWTR Deal Process

Moreover, even more questions are raised by the beginning, the deal's progress, and the result of the transaction.

On October 4, 2022, Bloomberg reported, citing unnamed sources familiar with the matter, that Elon Musk agreed to proceed with his $44 billion deal to buy Twitter (TWTR). Going back, there was a long dispute process between Twitter and Musk in which the TWTR price has been extremely volatile, falling or rising sharply, significantly damaging both long and short holders and derivatives traders.

At the same time, without any materially significant new facts that could change the position of the parties, Musk decided to close the deal on the original terms, which gives rise to grounds to suspect him of either price manipulations or negligence in the course of M&A.

Ultimately, in this case alone, we see multiple suspected violations of the rights of shareholders and holders of other financial instruments. The company's management, board of directors, and big capital holders solve their issues and do not take minorities' interests into the account. It is time to remind companies that they work for all shareholders. The 11thestate platform gives sophisticated tools to protect investors' rights not only to shareholders but also to traders of derivatives, bonds, holders of short positions, and crypto assets.

%%type:order-card,id:336%%

%%type:order-card,id:286%%

%%type:order-card,id:86%%

%%type:order-card,id:295%%

%%type:order-card,id:280%%

%%type:order-card,id:296%%

%%type:order-card,id:241%%

%%type:order-card,id:200%%

%%type:order-card,id:308%%

%%type:order-card,id:262%%

%%type:order-card,id:226%%